Cloudflare stock 2023

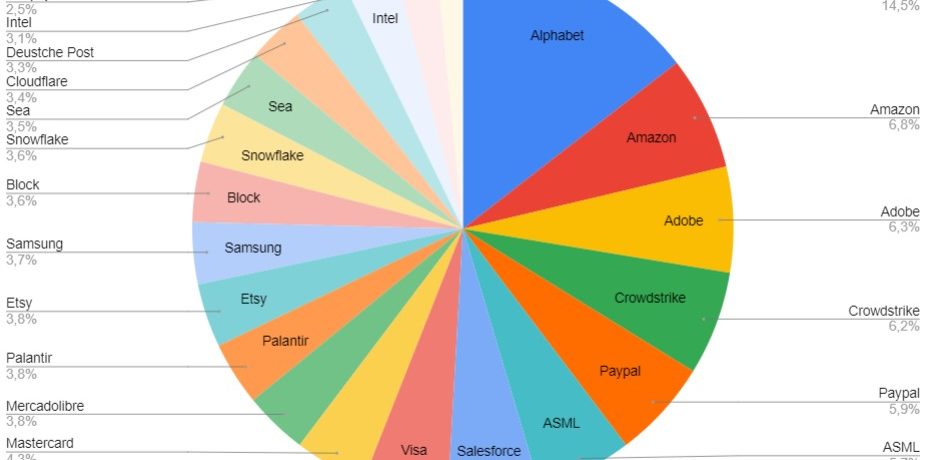

I’m invested in Cloudflare through my Wifolio-certificate. Pr December 2022 Cloudflare had a share of 2.8% of the Wikifolio. Pr today I lost 46,3% with this position. This is no investment advice. Cloudflare is a global network designed to make everything you connect to the Internet secure, private, fast, and reliable. (cloudflare.com) – – Cloudflare […]