Summer 2024 / Final? Update

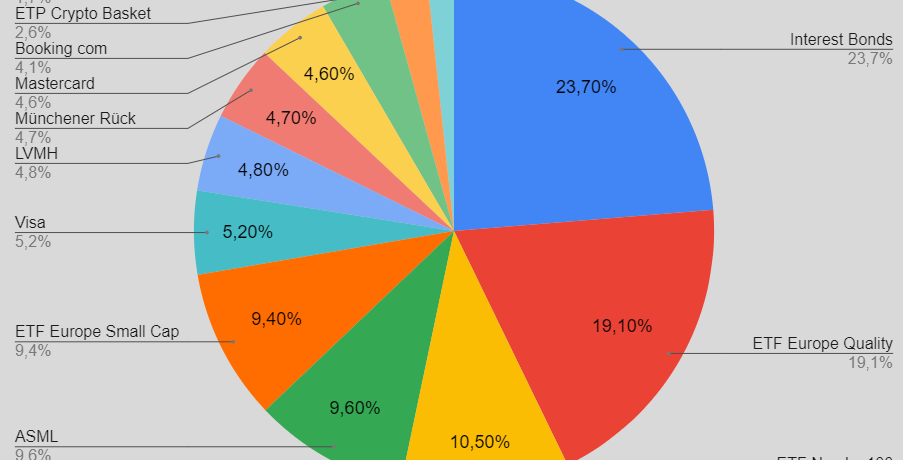

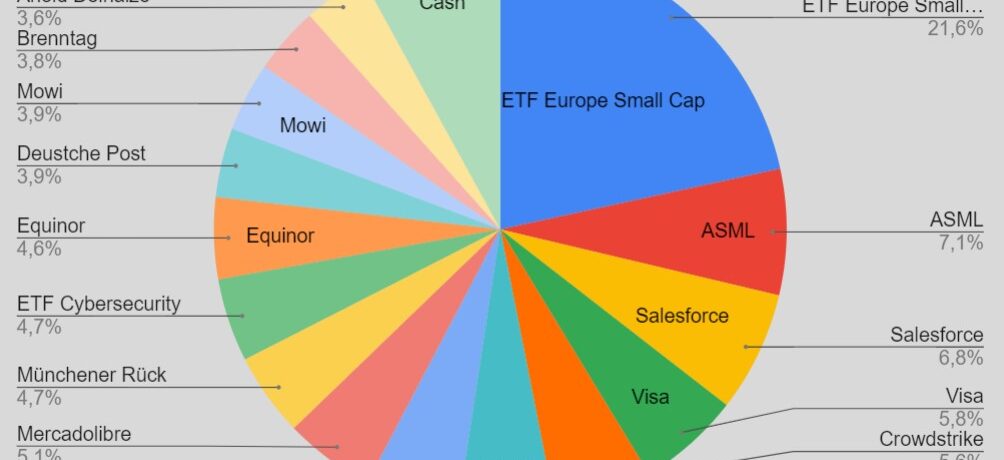

My Tobinvest portfolio remains firmly rooted in the strategy I’ve carefully developed over time. As expected, the portfolio’s value and returns have been closely tracking the stock market’s movements, with the usual ups and downs that come with market fluctuations. As of August, my portfolio is hovering near the all-time high it reached last month. […]