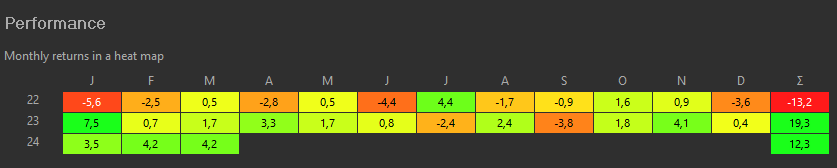

As we close the first quarter, both the most important stock market indices and my portfolio have reached all-time highs. These returns also reflect some positive currency effects, notably due to the weakening of the NOK against USD and EUR.

—

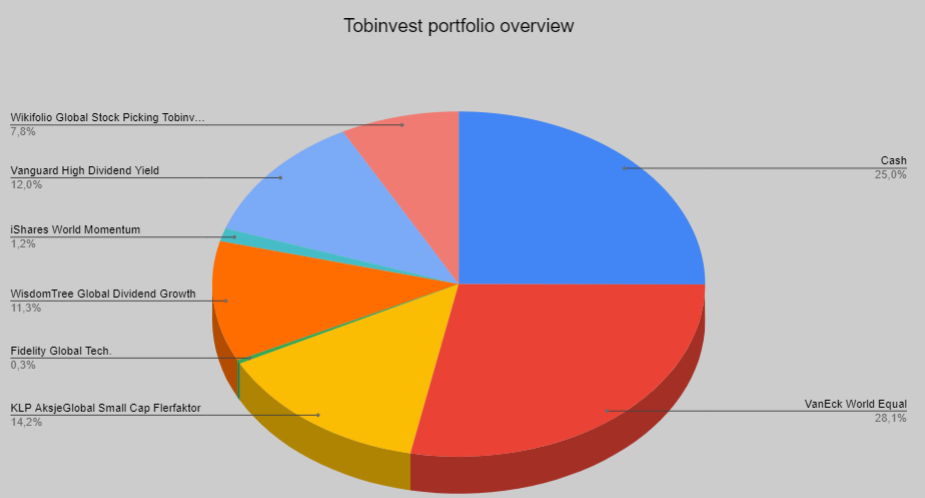

Notably, the high-risk equities in my portfolio, including the iShares MSCI World Momentum ETF and my Wikifolio Global Stock Picking Tobinvest, have demonstrated robust outperformance over recent months.

The relief rally ensued following the announcement of impending interest rate reductions, fueling expectations of increased profitability for companies. It will be intriguing to observe how swiftly such reductions translate into improved financial reports for publicly listed companies. However, the possibility of postponing rate cuts persists as long as the American economy maintains its robust growth trajectory.

On the flip side, potential escalation of economic tensions between the West and China, alongside an extension of the Russian conflict, pose looming risks.

In response to market dynamics, adjustments have been made to the portfolio. The iShares MSCI World Momentum ETF and the interest bond fund have been sold, freeing up cash for reinvestment in the stock market. Given the current market highs, a gradual investment approach over several months is under consideration.

The Momentum ETF will be reintroduced to the portfolio to reclaim its previous allocation. Additionally, a portion of the cash will be allocated to the Fidelity Global Technology fund, renowned for its impressive track record of 216% accumulated returns over the last 5 years. This fund is perceived as a high-risk, high-reward addition, offering superior growth prospects compared to other equities.

Furthermore, the remaining cash will be deployed into the Holberg Global A Fund throughout 2024, aiming to reduce cash and low volatility holdings to almost zero by year-end. This shift reflects the pursuit of higher returns amidst low interest rates and introduces active managed funds into the portfolio.

—

Contemplation also surrounds the reduction of rebalancing periods from three to one (Christmas), allowing for more strategic deployment of funds throughout the year. Cash generated from distributing funds like VanEck Equal World, Vanguard All World High Dividend, WisdomTree Global Quality Dividend Growth, and Fidelity Global Technology can be utilized during market downturns or year-end rebalancing.

These strategic adjustments aim to enhance portfolio resilience, capitalize on growth opportunities, and navigate evolving market dynamics effectively.