Summary

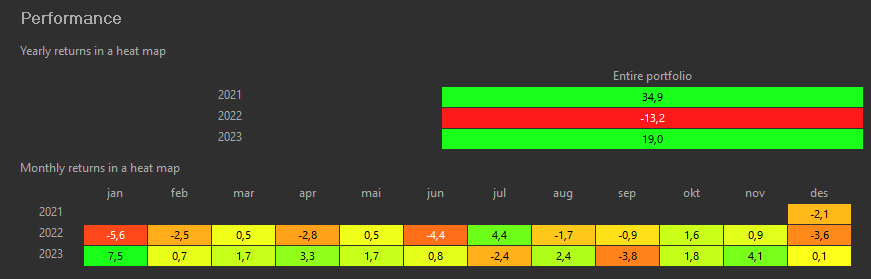

The year kicked off with a strong recovery from a challenging December in 2022, bringing a solid 7.5% return for my portfolio in January. Recognizing the volatility from the previous year, I opted to enhance diversification.

—

Market positivity prevailed until June, with a more stable summer, and continued growth in the latter part of the year. The final quarter saw some impact from diminishing inflation figures and hopes of reaching the interest rate peak.

Overall, 2023 delivered a satisfying 19% return.

To simplify, I reduced the number of equities and sales transactions—adopting a straightforward “buy and hold” strategy.

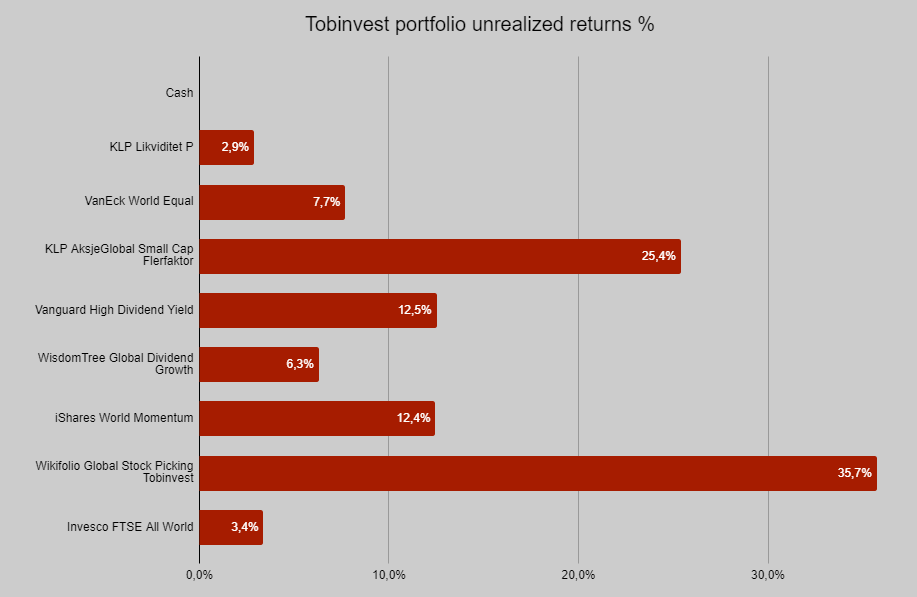

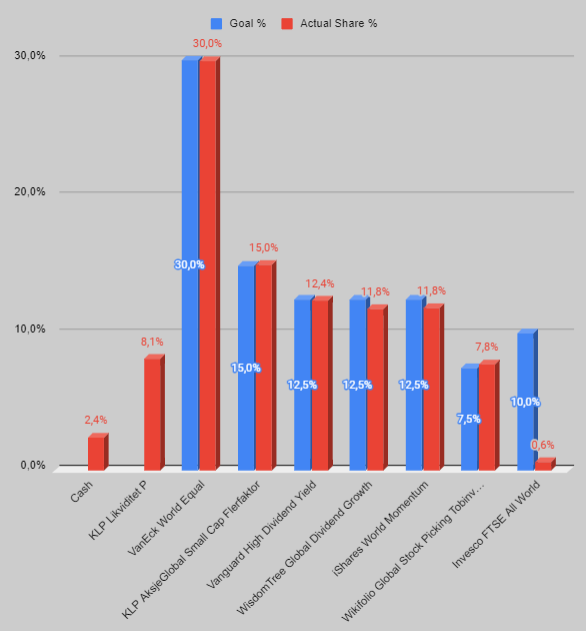

My portfolio now features 4 dividend-paying ETFs, forming the foundation for Tobinvest AS’s essential cash flow. Remaining dividends and monthly savings are channeled into equities. The KLP AksjeGlobal Small Cap fund and the Momentum ETF are not paying dividends.

—

Wikifolio

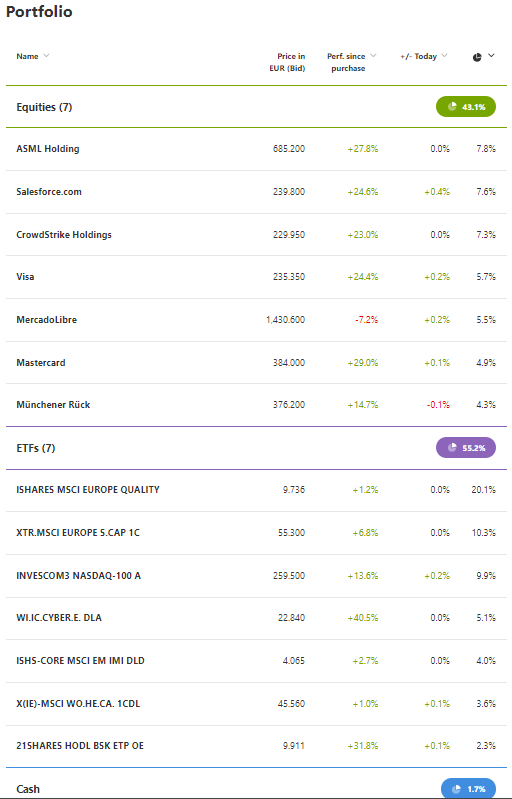

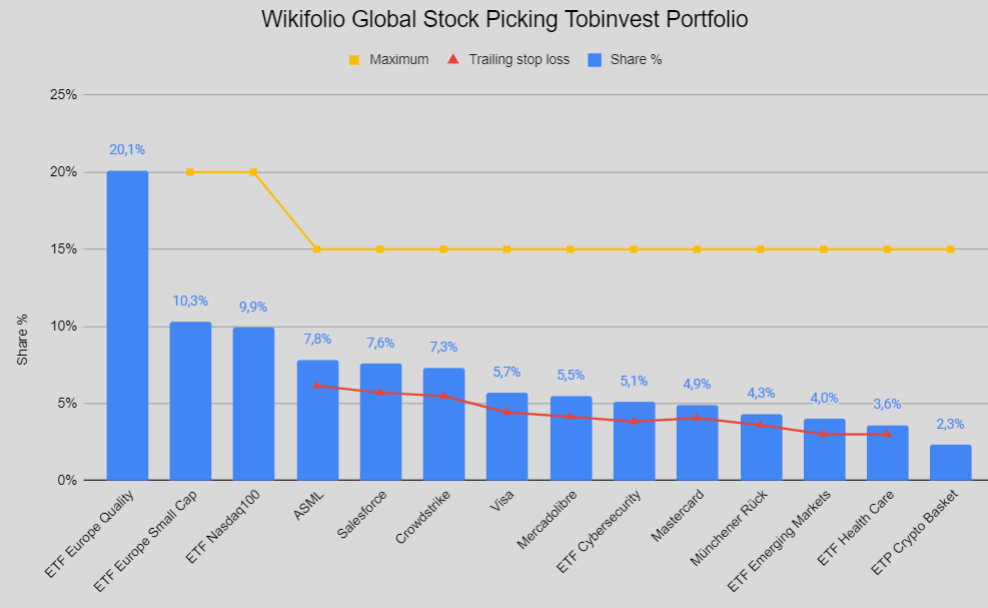

The Wikifolio Global Stockpicking Tobinvest, the active part of my portfolio, experienced a significant 28.3% increase in EUR. During this surge, some stocks were sold, and the proceeds were invested in various ETFs, making the Wikifolio more diversified than ever. At the moment, there are seven stocks and seven ETFs in the Wikifolio.

—

There were 21 transactions in the Wikifolio this year, mainly aimed at safeguarding gains after robust performance. My goal for 2024 is to substantially reduce the number of transactions.

In adherence to a disciplined sales strategy, transactions are initiated through a stop-loss trigger. The stop-loss is intricately tied to the relative share of each equity in the portfolio, set at 25% below the initial share. Regular updates, conducted quarterly, ensure the trigger remains finely tuned. The figure below illustrates the current stop-loss levels for each equity. The overarching goal of this approach is to retain strong-performing assets while shedding those exhibiting relative weakness.

—

Certain ETFs, considered foundational investments, operate without a stop loss, aligning with the overarching strategy.

The Europe Quality ETF serves as a temporary placeholder, awaiting opportune moments for potential replacements with individual stocks or more specified ETFs. This ETF employs a Quality factor, utilizing criteria such as Earning Stability, Return on Equity, Debt-to-Equity Ratio, Profit Margins, Dividend Growth, and Management Efficiency to construct a robust portfolio.

This deliberate strategy aims not only to safeguard gains but also to strategically position the portfolio for optimal performance by retaining winners and divesting equities that exhibit relative weakness.

Anticipating a two to three-year timeline to reach the original price level of 100, my mid-term goal for the Wikifolio reflects a 27% upside. More info about the wikifolio, here.

Tobinvest AS

My investment company, now two years old, is fully invested, and dividends cover necessary cash requirements. However, the Norwegian Authorities now mandate an accounting system from year-end 2023, introducing an additional recurring cost.

For now, the company effectively serves its purpose for my long-term investments, demanding a constant awareness of accounting standards and other regulatory aspects.

Performance

The total performance showed a commendable 19% increase.

| KPI | Status |

| Annual saving target | Achieved in 2023 |

| Minimize sales transactions | 7 YTD – Achieved in 2023 |

| Annual Returns surpassing the Benchmark | 19.0% vs 28.3% (KLP AksjeGlobal Indeks) – not achieved |

—

Compared to an MSCI Core World ETF, my portfolio exhibits an underweight in Technologies, particularly in the Magnificent 7 (Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, Tesla), impacting overall performance.

Benchmark NOK

—

Nevertheless, given the current high valuation of these companies, I’m content with the diversity in my portfolio for the foreseeable future.

All equities in my are showing positive returns for the moment.

—

Performance measures will be updated continously here.

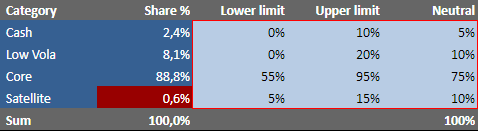

Portfolio Risk Management

Early in 2024, the Low volatility category shall shift to neutral weighting and further investments shall be focused on ETFs.

—

Significant Trades

Several noteworthy trades occurred in 2023, including the sale of Vanguard All World, xtrackers MSCI World IT, and VanEck Vektors Video Gaming & eSports ETFs. Notable additions include the VanEck World Equal Weighted ETF.

—

Aligned with rising interest rates, NorQuant Multi Asset and Sissener Canopus funds were sold and replaced by the interest fund KLP Likviditet. I exited Aker Solutions employee shares upon leaving the company.

December witnessed an increase in positions in VanEck World Equal Weighted and Vanguard High Dividend Yield in line with the portfolio’s rebalancing signal.

Outlook 2024

In the upcoming months, I plan to boost exposure to interest funds, aiming for a minimum of 10%. Additionally, I’m contemplating a shift from the current practice of rebalancing three times a year to a more dynamic approach of monthly ETF investments. The rationale behind this adjustment is rooted in the belief that time in the market stands as a potent factor in optimizing gains.

—

Moreover, I’m evaluating the balance between traditional rebalancing and the strategy of adding to winning positions. While rebalancing ensures stability by preserving a diversified portfolio, augmenting successful investments seeks to ride the momentum and extract maximum returns.

Patience will guide decisions in 2024, aiming to seize promising opportunities.

Purpose of the Annual Letter

This letter serves as a reflective overview of the portfolio’s status over the last 12 months, aiming to inspire my network to engage in financial discussions. The retrospection is a tool for refining investment decisions, aligning with long-term goals of creating a portfolio contributing to financial independence through annual returns.