I’m pleased to share that my portfolio has shown strong growth this year, with a remarkable 15.5% increase year-to-date. During the initial six months, I enjoyed consistent positive developments that fueled this growth. However, it’s worth noting that July brought about a minor setback, primarily due to the currency dynamics between NOK and USD. This shift had a notable impact on the portfolio’s performance during that month.

—

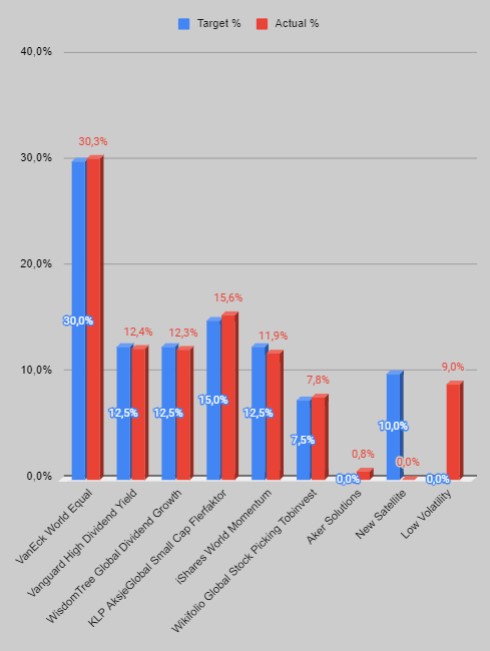

Over the past three months, the portfolio’s value has maintained relative stability, exhibiting only marginal changes. At present, the composition of the portfolio remains largely unchanged, with all positions closely aligned with their target allocations.

I intend to maintain the current structure of the portfolio, as I believe it to be well-suited to my financial goals. Although there are no imminent changes planned, I will continue to make monthly contributions to the KLP Likviditet Bond ETF, which plays a key role in the Low Volatility segment of my investments. It’s worth noting that I have a contingency plan in place for this category. In the event of market turmoil driven by fear, I will consider transitioning to a stock market fund.

—

In terms of recent actions, I utilized received dividends to bolster my position in the Vanguard High Dividend Yield fund, a move that aligns with my investment strategy. Conversely, I made the decision to divest from the Sissener Canopus fund during the second quarter. This choice was motivated by the fund’s underwhelming performance in 2023.

Looking ahead, I’m mindful of the historical trends that mark August and September as months with traditionally subdued performance. As such, I am eager to closely monitor the evolving landscape of economic growth, inflation, and interest rates in the coming months. These factors are likely to shape the trajectory of my portfolio and offer valuable insights into the broader financial landscape.