Defining the Goal

Build an investment portfolio that outpaces inflation, securing annual returns higher than 5%.

Key Performance Indicators (KPIs)

To stay on track, I’ve set three KPIs as my guiding stars:

- Annual Saving Target

- Minimizing portfolio turnover rate

- Being fully invested

Meeting these targets ensures I’m not just treading water but actively steering my financial ship towards success.

Investment Categories

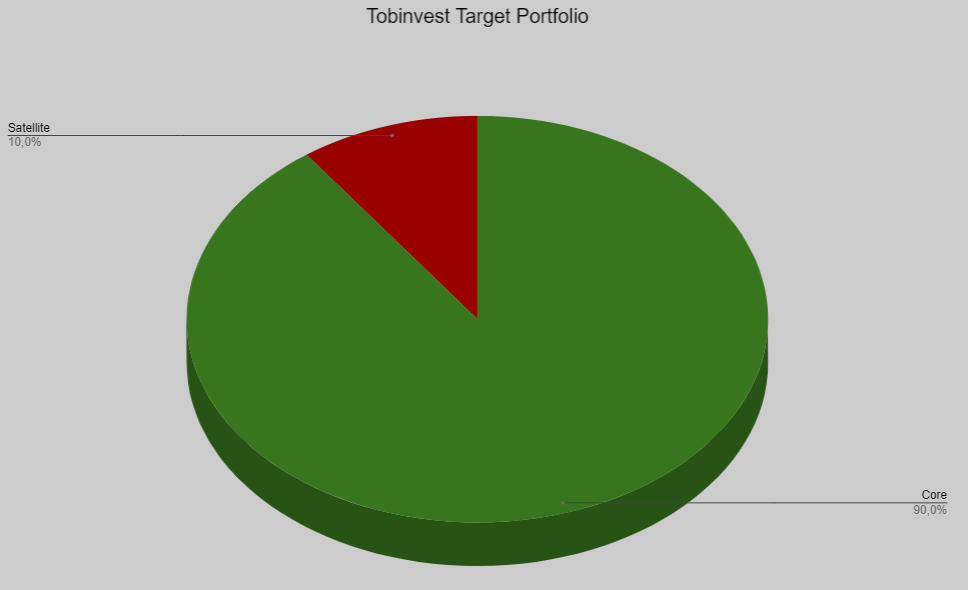

I’ve embraced the Core-Satellite mindset, a strategy built on the foundation of two distinct components: Core and Satellites.

Core: Long-Term Stability

- Long-term investments that focus on increasing positions rather than selling.

- Limited amount of positions for close and effective monitoring.

- Individual stocks won’t dominate my portfolio.

Satellites: Strategic Growth Opportunities

- Monthly Dollar-Cost Averaging (DCA)

- Extra purchases during market pessimism (CNN Fear & Greed Index below 20).

- Sold with a trailing stop loss at -25%.

- Adjust the stop loss if the value of satellite positions rises by 5%.

- Restricted to 15% of my portfolio.

Low Volatility Funds and Cash

- Monthly Dollar-Cost Averaging (DCA) for stability.

- Caps at 20% of my total portfolio.

- Pruned when the CNN Fear & Greed Index falls below 20.

Investment Instruments

Tobinvest AS: Core Position Holder

- A holding company focusing on core positions.

- Prioritizes dividend-paying equities for cash needs.

- Keeps transactions to a minimum.

Wikifolio Global Stock Picking Tobinvest: Certificate of Growth

- Tradable certificate on the Stuttgart Stock Exchange.

- Core position with a mix of equities (stocks, ETFs, etc.).

- New positions start at a minimum of 4% of my portfolio value.

- Quarterly updates and a stop loss at -25% of the position value.

- Maintains a fully invested stance, with less than 5% in cash.

- More info regarding my Wikifolio.

Personal Banking Accounts: My Satellite Focus

- Concentrates on satellite positions and DCA.

- Building Low Volatility position and cash holdings