Last week in March was very positive for my portfolios, positive returns in every month this year (so far).

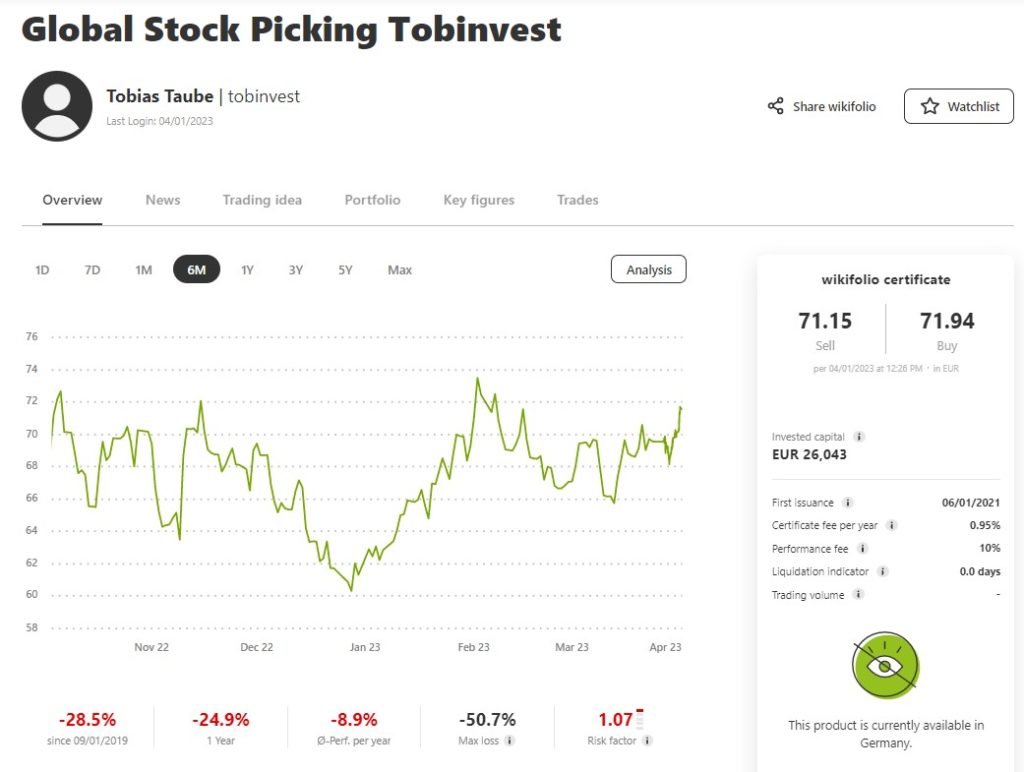

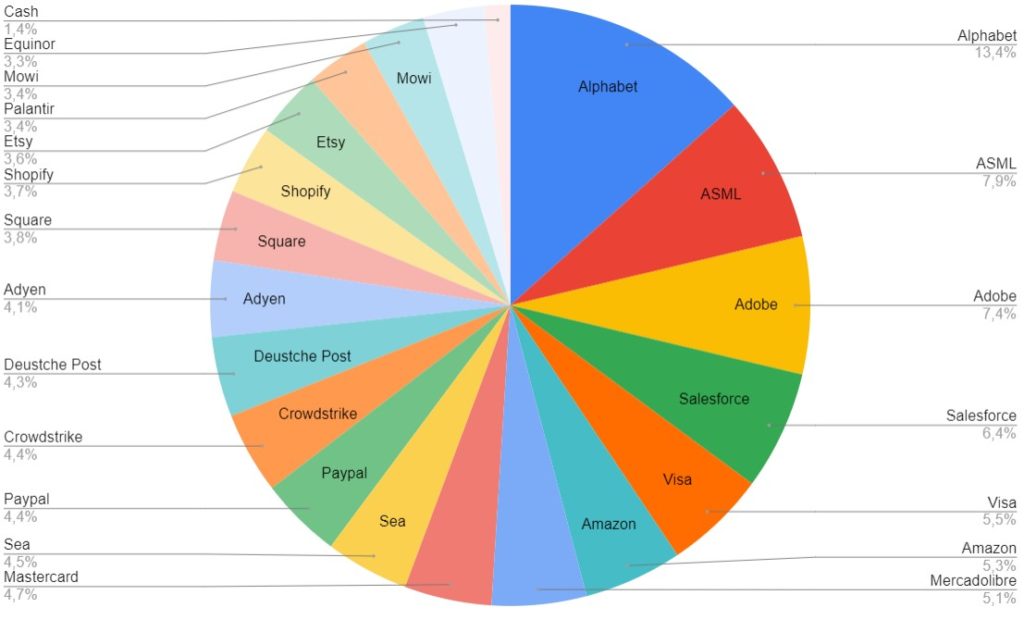

Wikifolio Global Stock Picking Tobinvest

The Wikifolio is up 16.7% YTD and had a nice rebound after 2022. The price is 71€ now, up from 61€ last quarter. Long-term development of the Wikifolio-certificate is still weak, down almost 30% since the start in 2019.

–

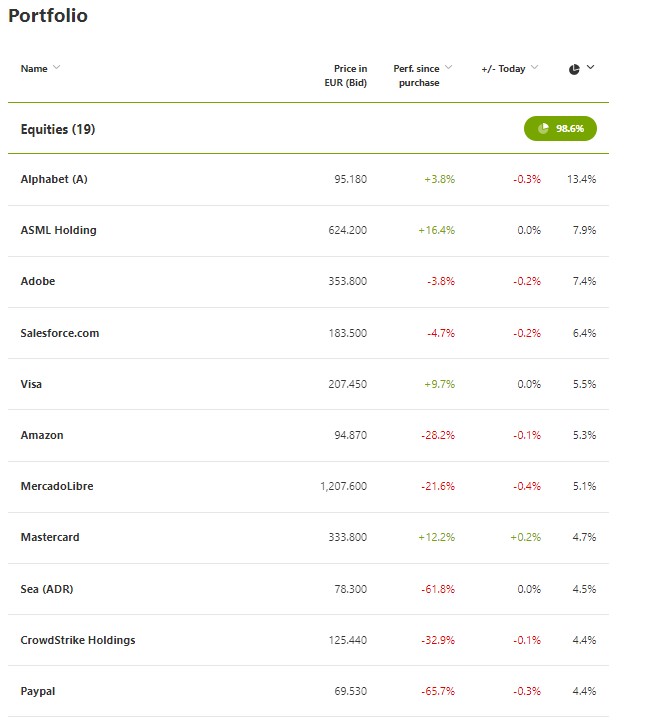

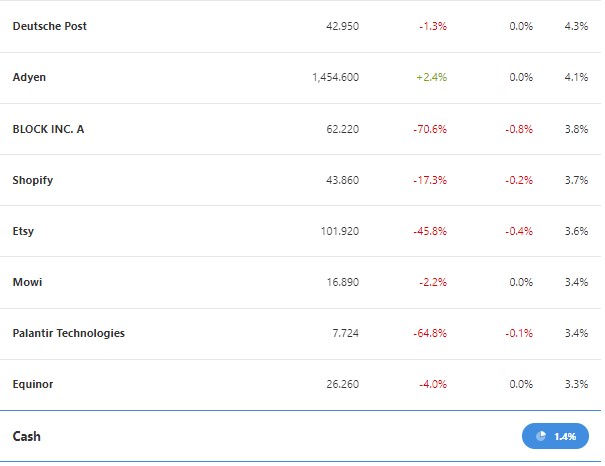

The top positions are are almost unchanged, but Salesforce and MercadoLibre had a nice rebound so far this year. The top ten are still 64% of the Wikifolio.

–

At the bottom we have my newest positions with Mowi and Equinor. I bought just for a share of 3.5% each, so I will add a share of 0.5% going forward.

No position is below my 3.0% stop-loss-signal. Nevertheless, I’m considering to reduce some US-Tech positions to add more (on) European stocks. Looks like Mowi will be my number one priority (time will show).

The key figures below confirm the strong development the last months, but also the weak long-term performance. The Wikifolio had a stronger development than the rest of my total portfolio. For the time being I have no plan to add on Wikifolio certificates, since the share in my total portfolio is above the target.

–

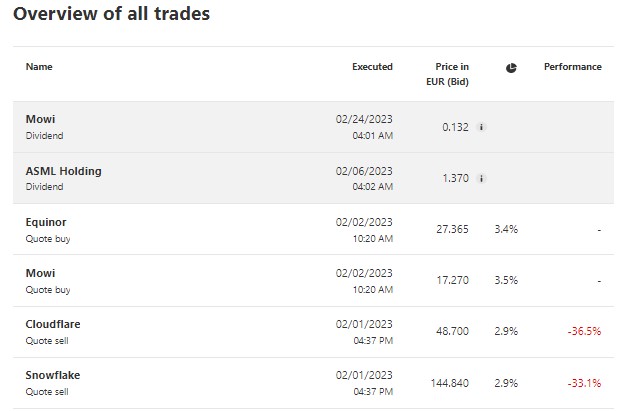

I sold Cloudflare and Snowflake in February, after a strong January. I replaced them with two norwegian stocks – Mowi and Equinor. Both export their products and will have positive impact from a weak Norwegian Krone. Both stocks have some challenges going forward. The Norwegian government will establish an extra tax for fish farms. There is a lot of uncertainty how big the impact of this tax will be. Margins at Equinor depends strongly on energy prices. A possible recession will have negative impact on Equinor.

Mowi and ASML contributed with some minor dividens in the first quarter.

–

Overall, the situation for the Wikifolio is improved since year-end 2022, but there still a lot of risks in the market for Tech/Growth stocks.

–

The journey with my own issued wikifolio continues, I will comment quaterly on the development on the blog. I would be happy if some would join this journey – either as investors, ambassadors and/or as discussion partners.

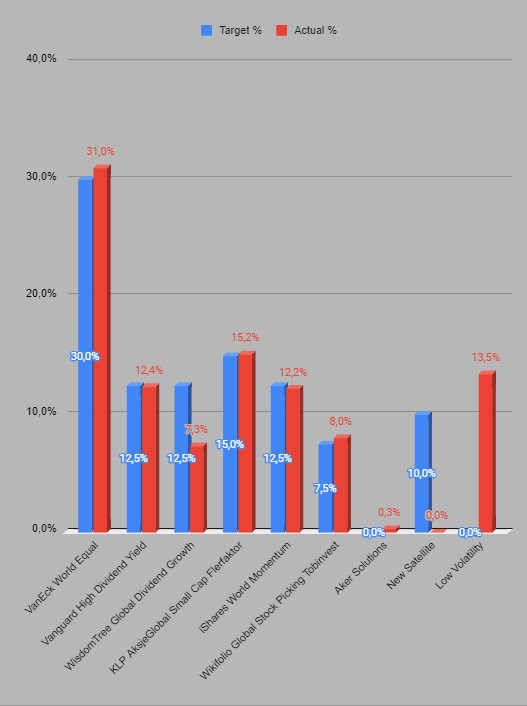

Tobinvest total portfolio

My total portfolio grew with 11.3% in the fist quarter 2023. This is the highest increase since the project was started. This increase includes deposits, without them the portfolio is up 10% YTD.

–

There were several changes in the portfolio since year-end 2022. After high returns in January, some of the sector ETF’s have been replaced by the Dividend Growth ETF and two low volatility funds. I added also a position in Aker Solutions through the share program for employees.

–

Almost all positions are close to their target share. I will continously considerate to selll the low volatility funds to add on the Global Dividend Growth ETF and a new Satellite position.

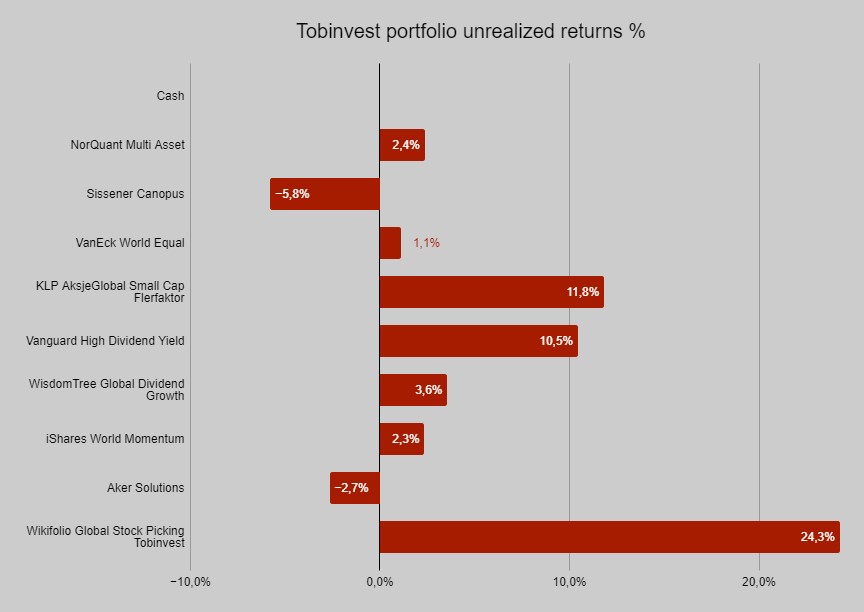

The two low volatility funds are NorQuant Multi Asset and Sissener Canopus. The development of Sissener Canopus was disappointing in March. I’m waiting for the monthly report from the management to understand this weak return. Actions have to be considered.

Positions with a return between -3% and +4% were mainly bought in the first quarter and it is too early to evaluate those.

The Wikifolio had a tremendous rebound as described above. For my total portfolio there was a positive currency impact in addition to the price increase. +24% is a nice return, but as described above the Wikifolio is ca. 30% below its startingpoint at the moment. I expect, it will take time to recover that.

–

Overall a very good start for my portfolio this year.