The price for the Tobinvest Global Stockpicking Wikifolio continued to increase through the 2nd quarter 2023. The investable certificate increased with 18.4% year-to-date. The price is 72.65 EUR now.

The increase so far this year, and the general marked development, are beyond my expectations.

—

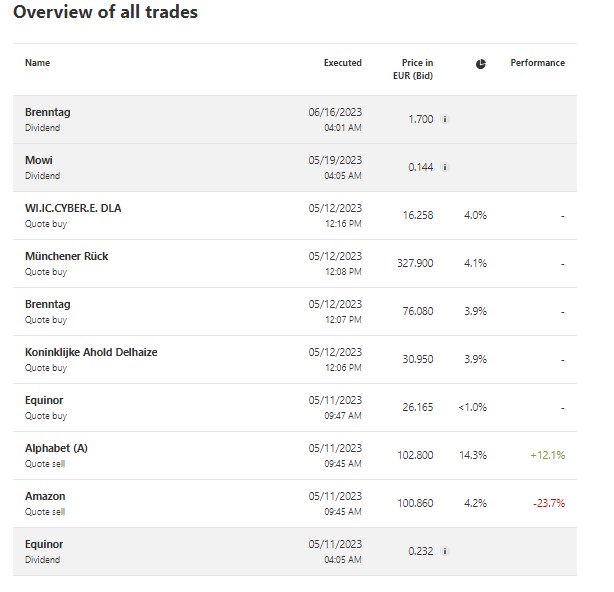

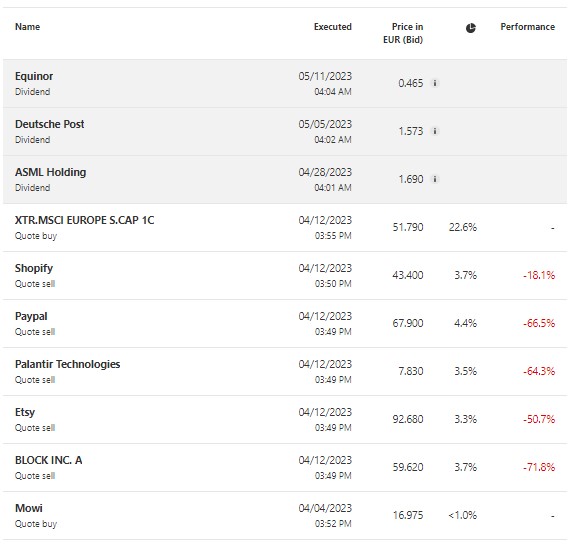

As mentioned in the blog post from April, I executed the plan to reduce several US-positions and increase exposure towards European companies.

—

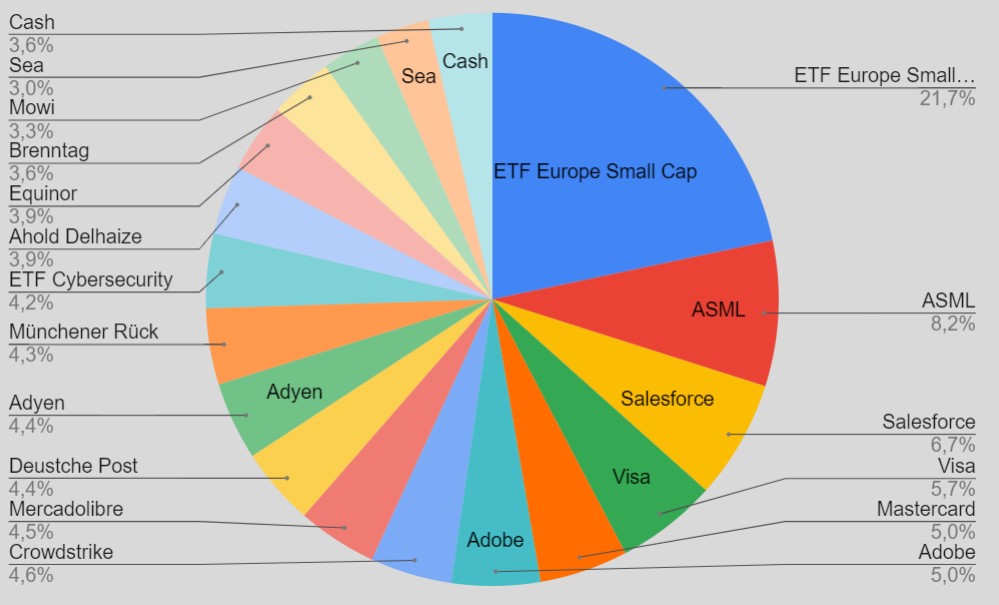

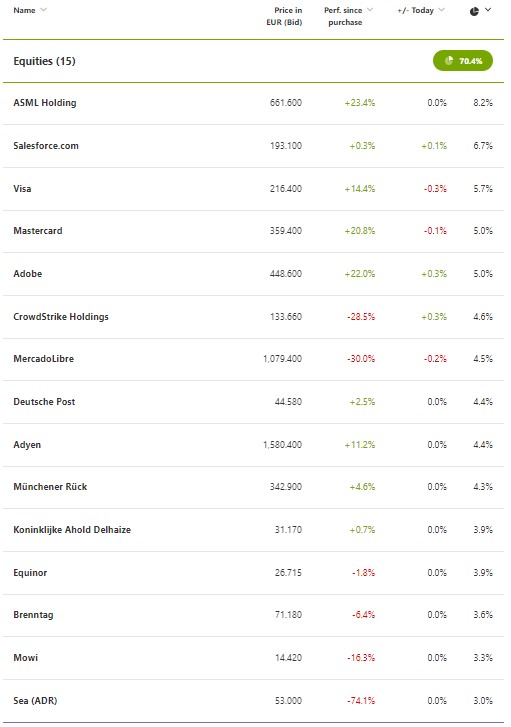

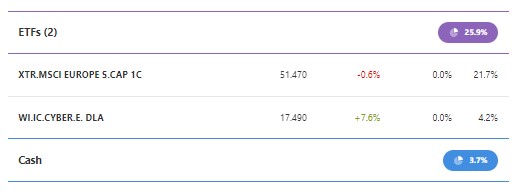

An ETF for European Small Cap is now the biggest position. In addition, I added Müchener Rück (GER), Equinor (NO), Ahold Delhaize (NL), Brenntag (GER) and Mowi (NO) to the certificate. There are still some US companies in the Wikifolio, these will remain there.

—

The Dutch semiconductor stock, ASML and US Big Tech stocks, as Salesforce, Visa, Adobe and Mastercard, had the best performance in the wikifolio this year.

The top ten individual stocks have a share of 51.4%. More than 10% less than last quarter, but still concentrated.

The Key figures are showing the positive trend so far this year, but also for the last 12 months. I expect that it will still take a lot of time to achieve positive margins since creation, but I’m aiming to get there with patience and discipline.

—

As mentioned above, there were several trades in the last quarter. In addition, dividends have been received from Equinor, Deutsche Post and ASML.

—

I continued to develop the trailing stop loss strategy for the wikifolio. I set a trailing stop loss for all positions, excluding the European Small Cap ETF. The trailing stop loss will be set at -25% and will be updated quarterly.

—

The trailing stop loss will be used when equities have been in the wikifolio for at least 12 months.

Sea Limited is close to its stop loss and was bought in 2021. The company is struggling with negative margins and reduced growth at the moment. Will check the status again in three months.

The journey with my own issued wikifolio continues, I will comment quarterly on the development on the blog. I would be happy if some would join this journey – either as investors, ambassadors and/or as discussion partners.