I followed my strategy through the last 6 months, so I’m fully invested pr today. Remaining cash in the portfolio is below 2% and it is splitted on several accounts. Considering today’s cash level as fully invested.

I’m pleased that it was feasible for me to follow the strategy in a difficult environment at the stock market. Already now, I see that the timing was not perfect. Time will show if the results from the strategy will be acceptable.

Maybe perfect timing is impossible, but I want to improve my strategy continuously.

My experience from the last months is that I invested too much too quickly, when Nasdaq 100 was down 10% and 15%. The plan was to do some quick purchases, based on experiences from the covid crash in 2020, when there was a quick rebound. FOMO!

I expected an early ending of the war in the Ukraine and therefore an early focus on & agreed strategies for inflation. That was wrong.

How can the strategy be improved?

- Better to cut the -15% step in my strategy and focus on -10% and -20%?

- Better to use the S&P 500 instead of the Nasdaq 100?

- Maybe combine index levels with the CNN fear & greed index?

Going forward, I will invest my monthly savings directly into the stock market as long as Nasdaq 100 is staying below -20% from all time high. Due to the fact that I’m out of cash at the moment, there will be a lot less transactions in the coming months.

My considerations for crashes and rebounds was that everything will happen faster. Information are submitted around the world by seconds and the financial markets exaggerate in all ways. A typical rebound took from some months to several years in the past. Pr today the global economy is threatened by a long conflict between the West and the East. This uncertainty can lead to an economic slowdown that was beyond my considerations.

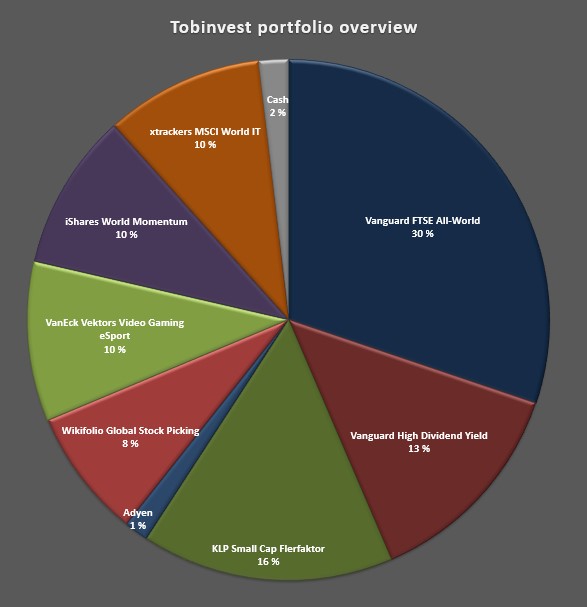

Personally I’m in a phase where I’m accumulating equities. In the long term it should be positive to buy on low levels like today. So I’m trying to be patient and not focus too much on today’s returns. My CORE positions (All World, High Dividend Yield, Small Cap) are about 60% of my portfolio, these positions are not so much down pr today. Regarding my US-Tech positions, I’m convinced that we will see a rebound at some time. The timeline for this rebound is more uncertain for me.

“The stock market is a device for transferring money from the impatient to the patient.” Warren Buffett