There are extraordinary times with the conflict between Russia and Ukraine and the high inflation. I will try to sum up some thoughts on portfolio structure in this text, that came up through the last weeks. This thoughts are limited on portfolio structure and do not consider any outcome or impact from the conflict between Russia and Ukraine.

Here are some moments that I’am not satisfied with:

- My share of cash has not given any significant returns over the last years and it was to high over a too long period of time.

- I’m not closely following up the companies that I own directly. I read some financial reports, but I’m not into valuating the business / product development or the management. The stocks of these companies were more volatile, through this extraordinary times, than I hoped.

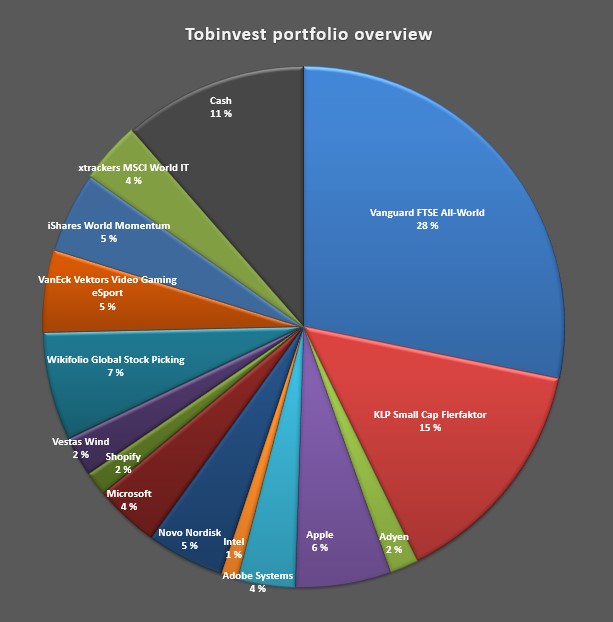

- There are 14 different equities in my portfolio at the moment, a lot of them correlate to eachother or funds include my company stocks. 14 equities are too much, a simplification should be considered.

Other moments worked fine for me:

- Following my strategy regarding purchases and risk allocation.

- Holding equities during weak periods.

Some goals to improve my portfolio stucture:

- Establish a bigger share of equities that pay dividends.

- Limit owning company stocks directly to my wikifolio.

- Establish a more specific plan to rebalance between growth and value investments.

Portfolio considerations

What about simplifying the portfolio?

Considerations on equities:

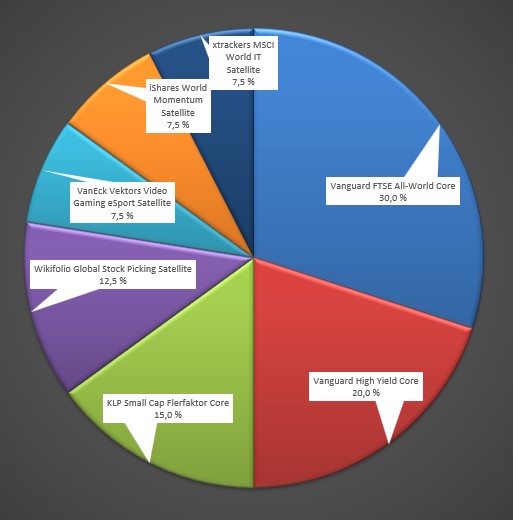

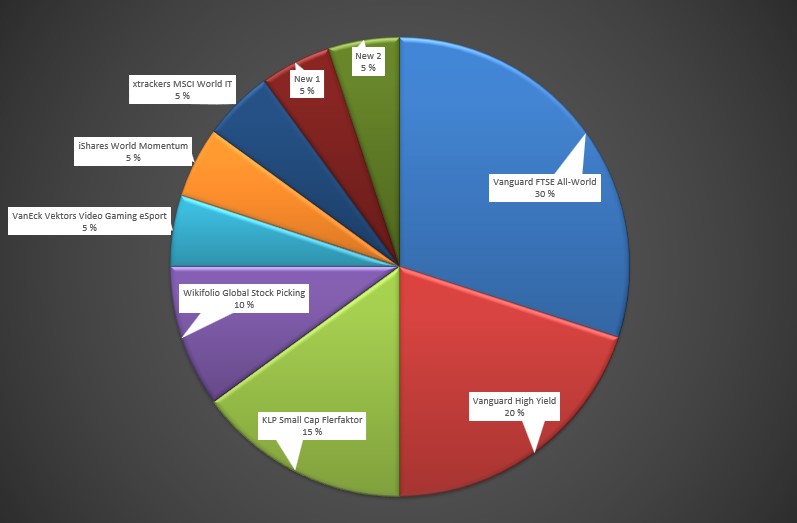

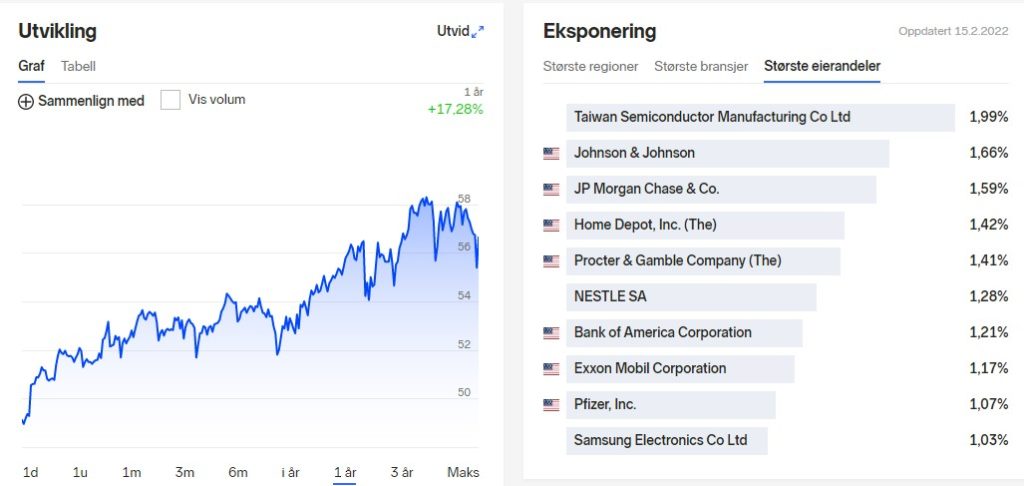

- Vanguard All World

- Classification: Core

- Goal weighting: 30%

- Dividend: ca. 1.6% annually (based on 2021 dividend)

- Todays weighting: 28%

- KLP Small Cap

- Classification: Core

- Goal weighting: 15%

- Dividend: zero or not relevant

- Todays weighting: 15%

- Vanguard High Dividend Yield

- Classification: Core (20%) / Satellite

- Goal weighting: minimum 20%

- Dividend: ca. 3.1% annually (based on 2021 dividend)

- Todays weighting: 0%

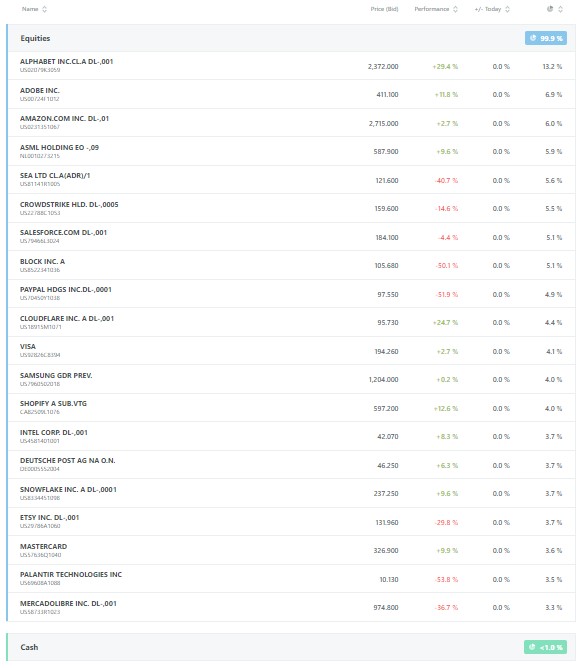

- Wikifolio Global Stock Picking Tobinvest

- Classification: Satellite

- High risk / high potential

- Goal weighting: 10 – 12.5%

- Dividend: zero or not relevant

- Todays weighting: 7%

- ETF`s

- Classification: Satellite

- Number of ETF`s: 3 – 5

- Goal weighting: 22.5 – 25%

- Dividend: zero or not relevant

- Todays weighting: 13.9%

- Define minimum return for each equity before buying

- More actively trading e.g. trailing stop loss

- Balancing against Vanguard High Dividend Yield

- Cash

- Goal weighting: 0%

- Todays weighting: 11%

- Considering Vanguard High Dividend Yield as substitute

- Monthly savings / cash from stop loss sales directly invested, continuous purchases or cash buffer

- Company stocks

- Goal weighting: 0%

- Todays weighting: 25.1%

- Today: Novo Nordisk, Apple, Microsoft, Adobe, Vestas Wind, Adyen, Intel

- All equities are included in the funds mentioned above

- Still possible for to pick those in my wikifolio

There is no conclusion on any changes yet. Earlier, I decided not to have a High Dividend Yield or Aristocrates fund in my portfolio. I wanted to focus more on growth with funds investments and buy additional some company stocks with satisfying dividend yield. The negative aspect about this is the growing number of positions, that should be followed up.

“Sometimes the most important thing to do is to do nothing.”