Goal

Achieve a portfolio that provides a significant annual return. The return should be a minimum of 5% annually. The strategy is based on a Core-Satellite mindset. This means a large core that is based on defensive and long-term investments. Traditionally, passive ETFs, i.e. on MSCI World and Emerging Markets indices, are used to cover the core. Tobinvest, on the other hand, uses ETFs, active funds and individual shares that are subjectively assessed as defensive investments. The satellites can be sector-, trend-based, short-term, etc., meaning more speculative.

Investment categories

The number of positions is limited to follow up the individual investments closely. At the same time, individual shares shall not be a large share of the total portfolio.

- Maximum 10 to 25 different positions (without cash accounts)

- Increase the number of positions step by step, e.g. two per year

- It is relevant to replace funds with individual shares in the long term

- Core

- Funds/ETFs

- Basic investments such as global or emerging markets

- Sector funds where I lack knowledge about individual shares

- Individual shares

- Quality stocks (relatively low multiples, good results, low debt)

- Growth companies (increasing revenue growth, unique products / services)

- Funds/ETFs

- Satellites

- ETFs

- Sector funds to focus on trends

- Individual shares, instruments

- Swing-trading

- ETFs

- Cash accounts

Change of investment category

It is possible to change satellite positions to core positions. A prerequisite is that a satellite position has been in the portfolio for at least 1.5 years.

Focus areas (in order of priority)

- Data/Technology

- Health Care

- Sustainability

- Global value companies

- Global growth companies

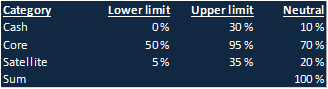

Weighting

Strategic allocations (Core & Satellites)

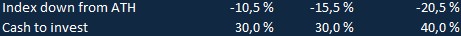

Purchase

The share of cash will be reduced if the S&P 500 and / or Nasdaq 100 fall below defined limits based on All time High.

If the following limit will be reached within 4 weeks after the previous limit, wait 4 weeks with the next purchase – evt. evaluate if it is interesting to place limit orders or split the purchase over the next 4 weeks.

If the next level is reached, minimum 4 weeks after the last purchase, invest immediately.

Rebalancing (Core & Satellites)

The portfolio will be rebalanced three times a year – at Easter, in August and in December.

- Purchase and sale of certain positions in the portfolio.

- Adjustment of monthly savings.

- Rebalancing is required when lower or upper limits in one or more categories are passed.

- Rebalancing is also required within the categories in accordance with the weighting of the individual positions. If the deviation to target weighting is significant, the positions will be adjusted.

Tactical Allocations (Satellites)

Purchases and sales of certain positions and adjustments of monthly savings, outside the rebalancing period, must be carefully considered.

Tactical changes are allowed because of.:

- Establish stockprice goals for Satellite positions

- Stop-loss / Trailing stop-loss assessments

- Advantageous buying opportunities

- Changes in the global economy

- Changes in profitability / estimates for industries / companies

Mortgage / Gearing

It is allowed to mortgage / gear the portfolio, if the market situation shows extraordinary opportunities.

Social media / networks

- Social media is used to get inspiration and for feedback

- The website tobinvest.com is updated with a blog post at least 3 times a year, along with the rebalancing.

- The Facebook group Tobinvest is updated at least with monthly status.

- Twitter is actively used.