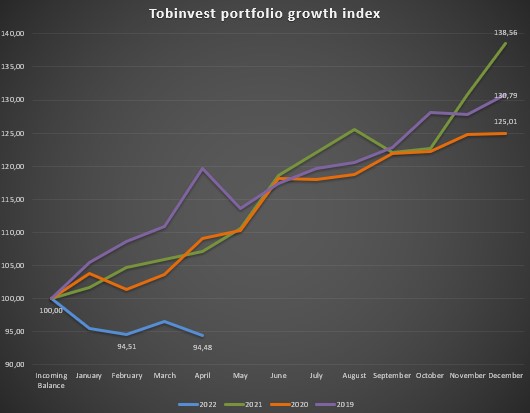

The stock market is still a rollercoaster this year. Every little increase is followed by (big) downturns. That is still annoying, but I got more used to see the red figures when looking at my portfolio – focusing on the long term – buy and hold.

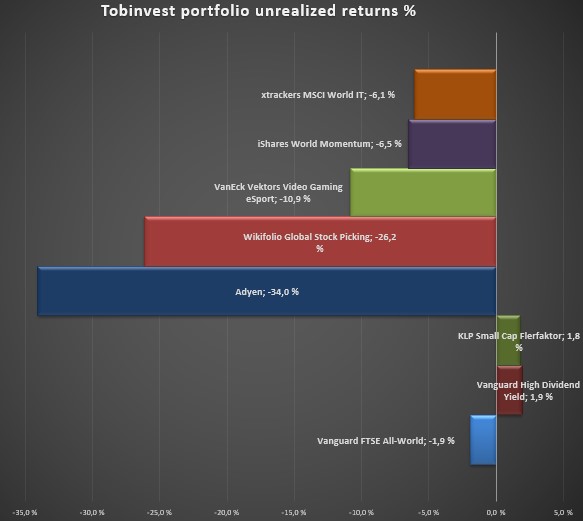

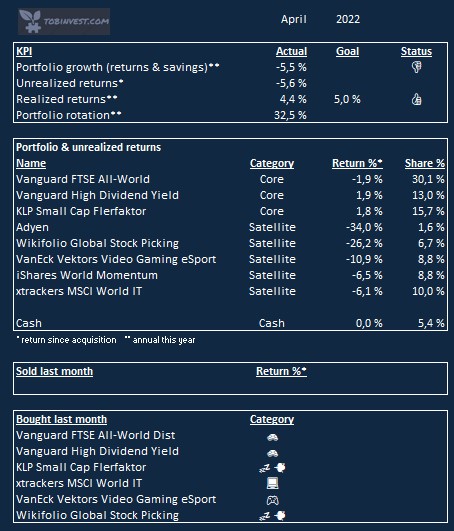

My portfolio lost 5.5% year to date. All investments, except Vanguard High Dividend Yield and KLP Small Cap, have negative returns since they were purchased. Without deposits the portfolio is down 11.2% year to date.

The Nasdaq 100 lost more than 20% from the all-time-high. These losses triggered purchases based on my strategy. I’m almost fully invested and keep buying as long as Nasdaq 100 is below 13.330. The share of cash in my portfolio is now at the lowest point for a very long time.

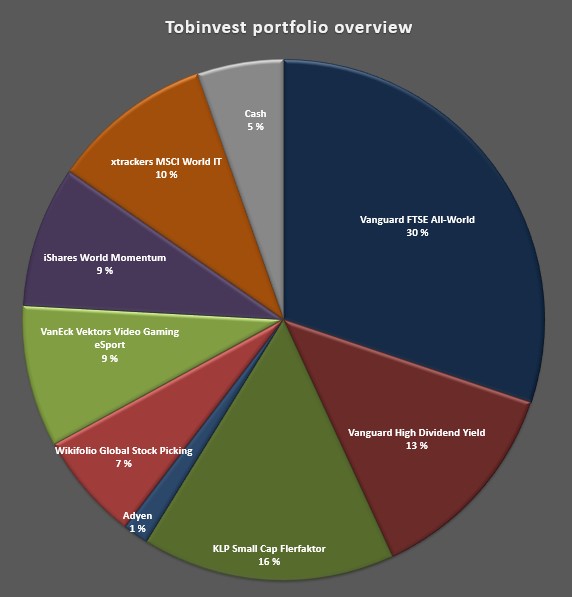

The transition from stocks to ETF’s was almost fulfilled during the Easter holidays. The portfolio consists of three core positions – All World, High Dividend Yield and Small Cap. In addition there are satellite positions within Technology, Gaming & e-sport, a Momentum strategy ETF and my Wikifolio. The Wikifolio contains mainly of high growth tech stocks that had a poor performance the last 6 months. I still have some stocks of Adyen that I plan to sell, for a reasonable price, as soon as possible. I am considering giving Adyen a place in my wikifolio instead.

There are still a lot of uncertainties for the financial markets – the war between Russia and Ukraine, Covid-19 (especially in China), Inflation and a feared Recession. Solutions on all these issues seem to be far ahead in the future and the mood in the market is quite poor at the moment. It’s always difficult, maybe impossible, to time the bottom. Therefore I decided to go all-in when the Nasdaq 100 is down more than 20% – could be wrong, could be right.

Since I’m soon out of cash and planned to just sell one position (Adyen), I expect that my portfolio will be a lot more stable and boring going forward. Purchases in the short term are planned for VanEck Video Gaming & eSport, iShares World Momentum and the Wikifolio Global Stock Picking. Next rebalancing is planned for the summer holidays.