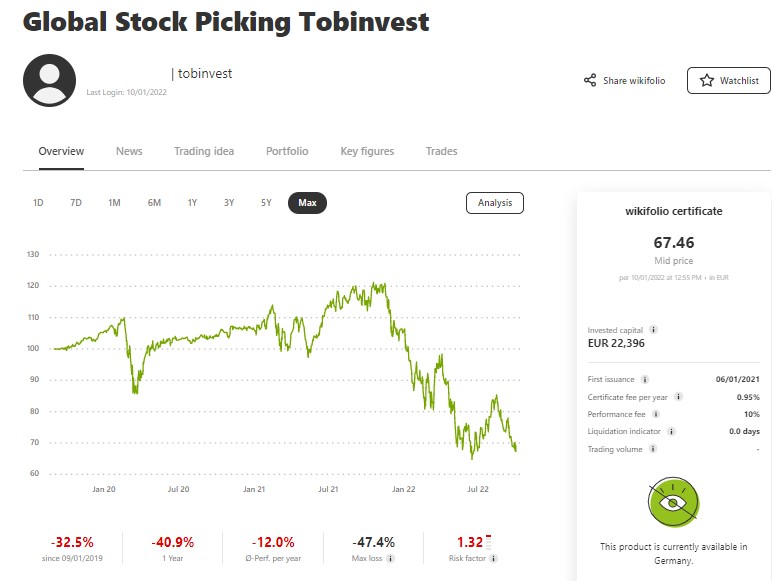

We have had some turbulent times in the financial markets this year. My Wikifolio Global Stock Picking Tobinvest was down to 67€ at the end of June, at the end of September we are again at 67€ – nothing happened the last 3 months 😉 Except that the Wikifolio was up to 85€ in mid August.

I’m still convinced of the equities in the Wikifolio, but I expect no gains until the financial market is in a better shape. I’m trying to prepare myself mentaly to that it will be worse before it’s getting better.

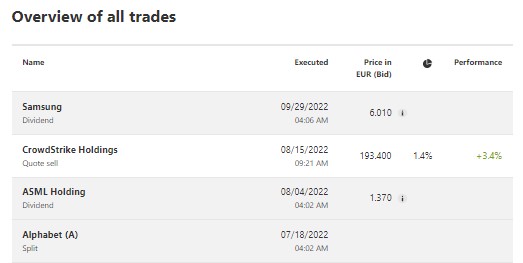

There were no relevant transactions in the wikifolio the last 3 months either. I reduced the Crowdstrike-position to secure enough cash for wikifolio fees for the next year. Quiet happy with the timing of that transaction and that the share was sold with a gain of 3.4%. ASML and Samsung paid their dividends in the last Quarter.

Regarding rebalancing, I will be consistent to the strategy described in the Q2 reporting.

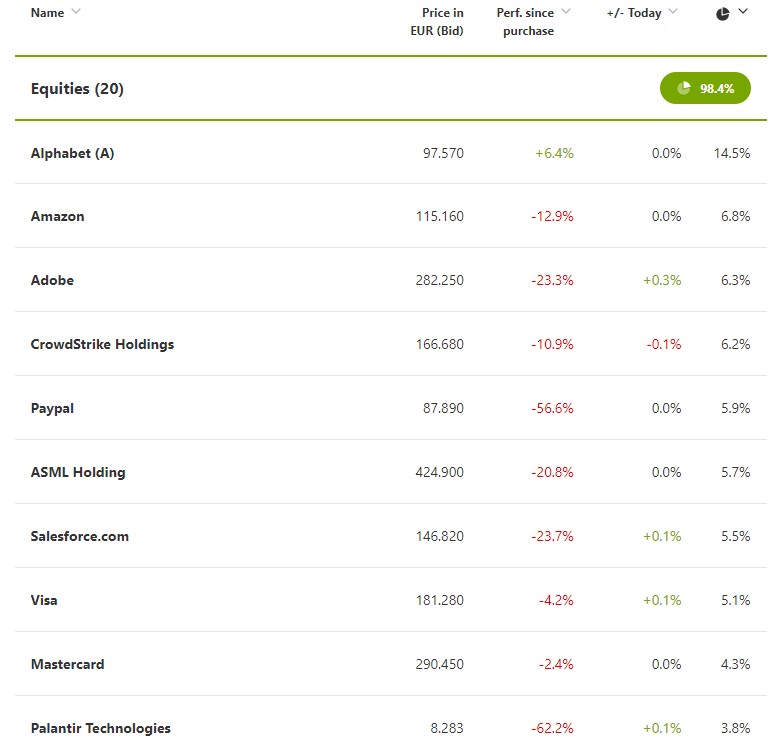

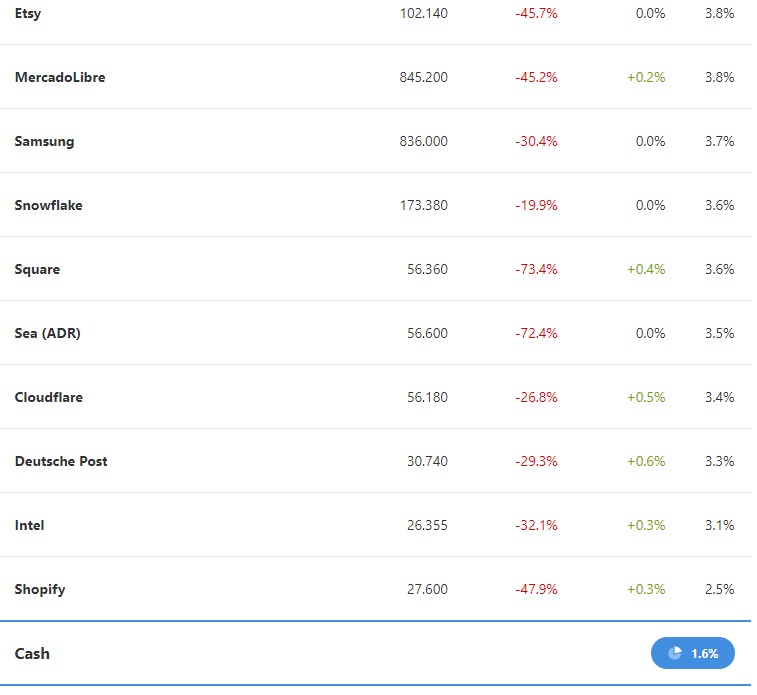

Alphabet (>15%), Etsy and MercadoLibre (both <3%) were outside the boundaries for keeping them at last quarter reporting. All 3 equities are within the levels at the end of the 3rd Quarter. There will no action on these equities in the coming months.

Shopify is, with a share of 2.5%, the only position within the selling levels. The Shopify position was bought in February 2022 and wasn’t in the Wikifolio for 1 year. Therefore I will keep the position as well (at least for one year). Spotify had a bad development for their financials the last Quarter. I will consider to sell this position after Q1 2023 if this development and the weak stock price performance continues.

Several of the owned equities reported strong Q2 financials. At the same time the outlook is getting weaker for a lot of them. Personally I consider to add on my Wikifolio Certificate position the next months. Purchases will be executed following the purchase rule described on my blog. Follow me on twitter to get updates on trades etc.

The Wikifolio represents the active part (7.4%) of my total portfolio. Global ETF’s stand for the biggest share of it. You find more information and monthly updates about it on my blog and my twitter account.

The journey with my own issued wikifolio continues, I will comment quarterly on the development on the blog. I would be happy if some would join this journey – either as investors, ambassadors and/or as discussion partners.