Summary 2022

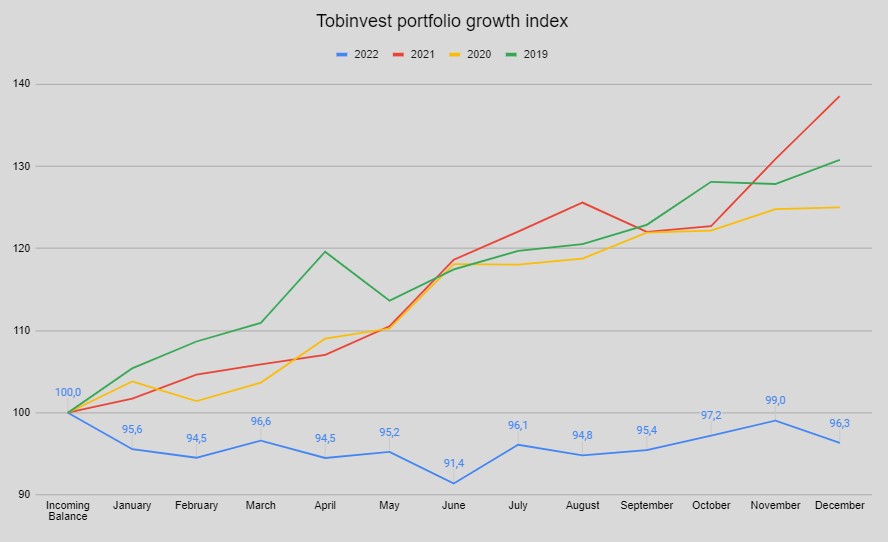

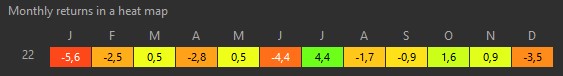

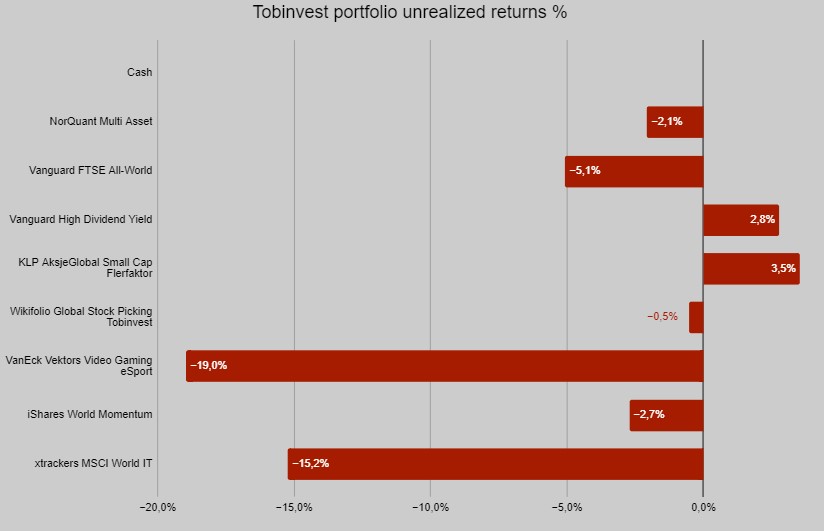

The value of the Tobinvest-portfolio decreased 3.7% in 2022. While returns were lower than expected, the savings exceeded the expectations this year. Without deposits from savings, the portfolio returns were -13,6%. Overall, a poor development in a weak period for financial markets.

Inflation was extremely high this year, year-to-year inflation for November was 6.5% in Norway.

The goal, to achieve returns of inflation plus 5%, was not met.

The Tobinvest goals, strategy and risk-management were further developed. The number of equities was significantly reduced, also the number of selling transactions. The share of cash was reduced to a minimum.

In total, 2022 was a back-to-earth year, after several years with extraordinary returns.

–

–

–

Wikifolio Global Stock Picking Tobinvest

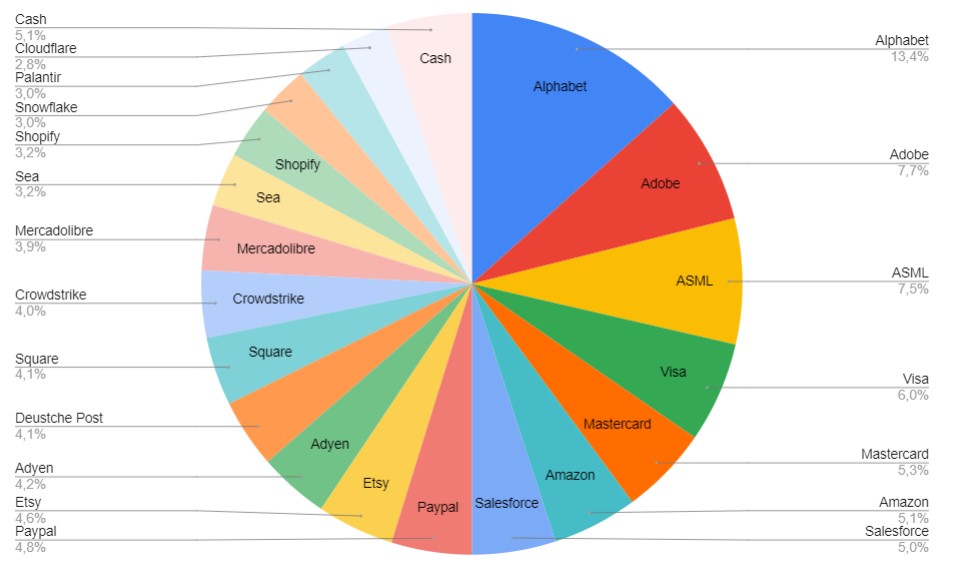

Wikifolio is a product that allows everyone to build their own portfolios and make them investable. The Global Stock Picking Tobinvest portfolio has the biggest share of my (high-) risk positions in the Tobinvest project. It includes mainly growth positions within technology and finance technology.

–

It is expected that the portfolio is highly volatile. The goal is high returns based on high patience. In the first round it is important to prove that this concept will work in a long-term perspective. There should be a successful history over some years before increasing effort to get external money into the portfolio.

High volatility was confirmed in 2022. The portfolio is down 42% in the last 12 months. It contains high growth technology stocks that are especially vulnerable to increasing interest rates, as we have seen during this year.

–

I’m grateful for the trust of my external investors, unfortunately they (and myself) got a very weak performance. Ongoing forward I expect still hard times for thess kind of equities. I expect that we have to get rid of recession and inflation fear before better times are coming. I will continue with the concept, but will decide carefully about further investments. More info about the Wikifolio…

–

Tobinvest AS

It was a quiet year for the company, there were no more equity deposits. The cash-flow from dividends is stable and covers all necessary costs. The Norwegian accounting rules require an accounting software for year-end-closing for 2023. That will be an additional operating cost for the company.

–

Performance vs. S&P 500, OBX, DAX

Creating stable returns is the goal for Tobinvest. The annual return should be minimum 5%, additional to inflation in Norway. Inflation was 6.5% in Norway last year. The returns should, over time, be higher than returns from comparable indices. I compare my returns with the main indices for American, Norwegian and German stock-markets. At the same time, there are annual goals for my saving-rates.

| OSEBX | -0,9% |

| S&P 500 | -19,9% |

| Nasdaq 100 | -33,7% |

| DAX | -13,1% |

–

Using Portfolio Performance software allows me to split returns and deposits easily. As mentioned above the growth was -3.7% with deposits; and -13.6% without deposits.

–

That was a weak performance and I’m not satisfied with this development. It is important to remember that these returns were made in a weak market environment and to focus on the long-term goals and principles (buy and hold).

–

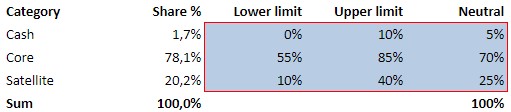

Portfolio risk management

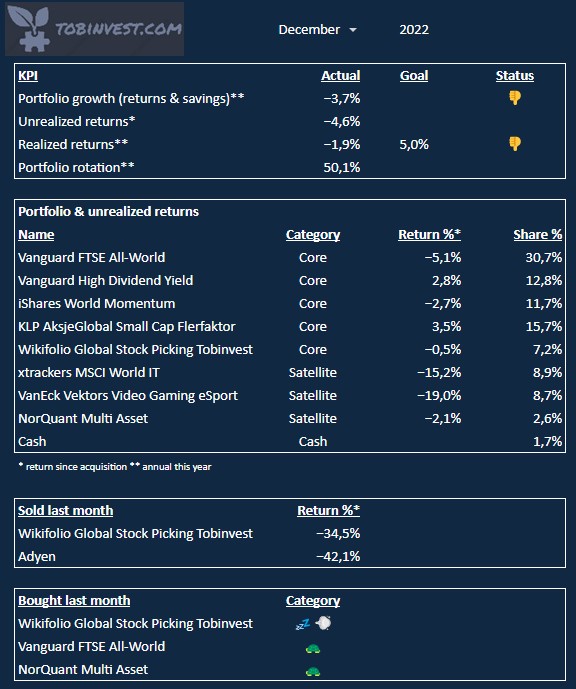

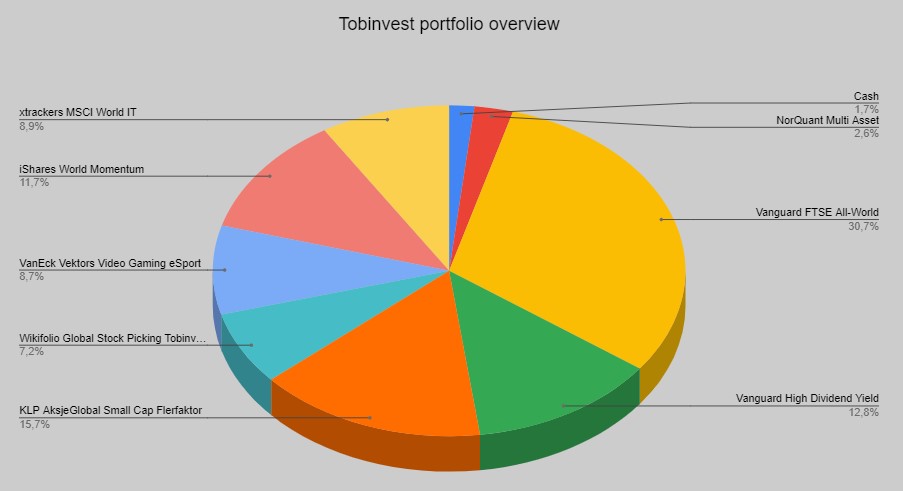

All investments were within their ranges on the 31st of December. The classification for the equities was updated to reflect which equities are for buy and hold only (Core) and which equities are short-term investments.

–

The Gaming & eSport ETF and the World IT ETF are considered as high risk. In total, these equities have a share of 20% of the portfolio (including short-term position NorQuant Multi Asset). Experiencing the decline for the two ETF’s, the risk was too high in 2022.

–

The long-term goal is to substitute the Gaming & eSport ETF with a more defensive dividend growth ETF.

–

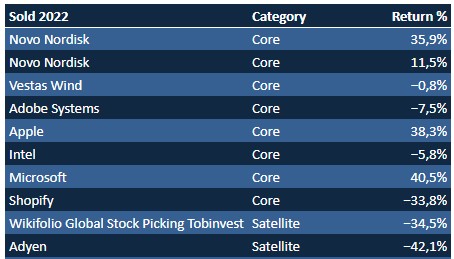

Significant trades

There have been 8 trades done in the first quarter. These were based on the consideration to substitute stocks with ETF’s to diversify the portfolio more in difficult times. In total these trades had significant positive returns.

The last two trades this year were done in December. Losses have been realized to start with clean sheets in 2023.

–

The amount of trades was reduced to ten, from 29 in 2020 and 16 in 2021. I’m satisfied with this trend and the goal is to have less than ten trades next year.

At the beginning of the year, there was a 20% share of cash in the portfolio. The cash was invested fully in the first half of the year. Retrospective, that was too quick. All trades are available in monthly reports on Twitter.

–

Outlook 2023

Expectations are low after this year. My saving-rate should be maintained, but I do not expect a significant increase in stock prices before the fear of recession and inflation is over. The plan is to accumulate on existing positions and add a dividend growth ETF. Investments should be done when the CNN Fear & Greed index is low or the share of cash becomes too high. Motivation is high to substitute the Gaming & eSport and the World IT ETF if low performance continues.

Further it is planned to simplify the monthly reports and focus more on the blog posts.

–

Purpose of the annual letter

This letter is a retrospective overview over the status of my portfolio for the last 12 months. It shall inspire my network to follow the financial markets and to discuss finance. Additionally, the letter shall force me to reflect about decisions made in the period. Hopefully, these reflections will improve my way of investing and keep me on the way to my long-term goals. The goal is to create a portfolio that, through annual returns, contributes to financial independence.