The Wikifolio Global Stock Picking Tobinvest represents the active part of my portfolio. It contains just stocks and no funds at the moment. I’m considering it as the high risks / high chances part in my investment world as well. Most stocks are linked to the high growth technology market segment and are widely overvalued regarding today’s financial figures. The growth and future financial achievements are the basis for the risks and the chances.

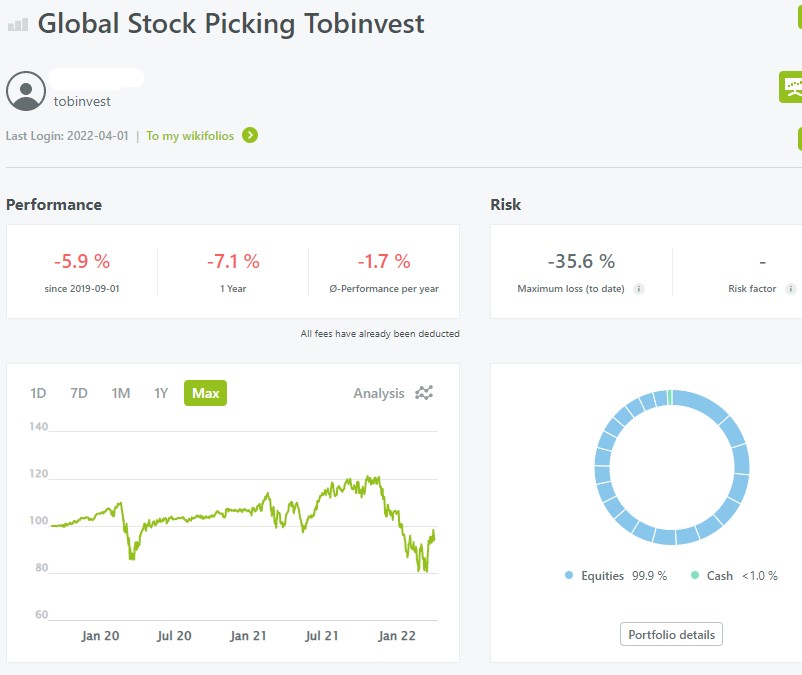

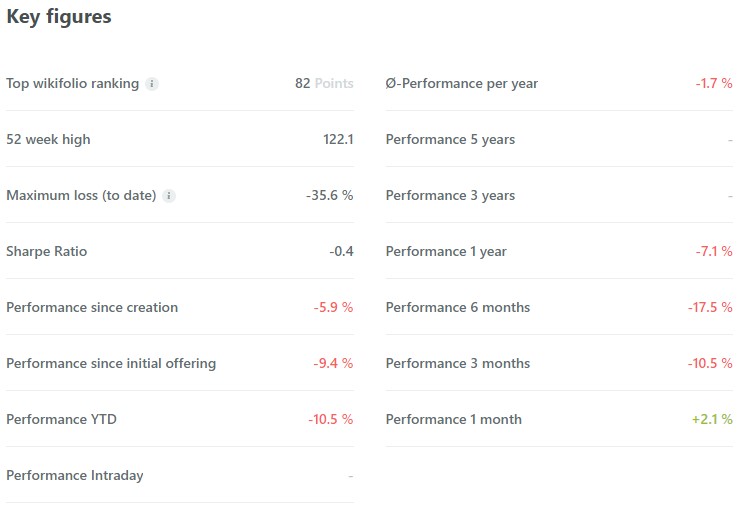

The high growth / future earnings market segment has given an extremely poor performance in the last 6 months. Increasing interest rates, inflation, fear about recession and the invasion of Ukraine has led to a lot of uncertainty in the financial market.

My Wikifolio had its high in November when the price of one share was 122 €. In February and March it hit the lowest price (so far) around 80 € per share. This reflects a dropdown of more than 30% in 4-5 months.

For comparison, the Ark Innovation ETF (ISIN: US00214Q1040) is down over 35% the last 6 months, while the iShares Core MSCI World (ISIN: IE00B4L5Y983) is 7% up over the same period.

When I’m writing this, the Wikifolio has a price around 95 € per share. It is really good to see that the Wikifolio is recovering relatively fast when the mood in the financial market improves.

Considering my own performance by buying shares of the Wikifolio, I have a negative performance. My buying price is around 106 € in average so far, that’s indicating a loss of about 10%. In addition, I have a currency loss since I measure my performance in NOK. NOK has strengthened compared to EUR by about 7% since I made my purchases. In total, my investment is about 17% down at the moment.

My plan for the coming months is to purchase more shares as long as the price is below 100 €.

The Wikifolio was issued in June 2021 and it is still a short history of performance. So far I got confirmation that the Wikifolio is more volatile than global basis funds. I will never promise any performance but I can guarantee skin in this game. In total there are 23.000 EUR invested at the moment.

Regarding the portfolio structure, Alphabet is the biggest position with 13.4%. The other 19 positions have a share between 3% and 7% each. It is planned to reconsider positions that were held at least one year and that have a share below 3% or above 15%, in the yearly rebalancing during summer.

I did some unplanned trades in February. My consideration was that Growth Tech was oversold at that time and there were some good possibilities to buy stocks on a good price. I sold some of the more defensive stocks with JP Morgan, Blackrock, Visa and Mastercard. At the same time I bought more Growth with Adobe, ASML, Shopify, Snowflake and Cloudflare. I also picked up some value/dividend stocks with Samsung, Deutsche Post and Intel. All these changes contributed to the rebound the Wikifolio had in the last weeks.

There are still some stocks on my watchlist and I’m considering to reduce my positions in Alphabet and Amazon to add those. But that hasn’t been decided yet.

As I described at the top, the Wikifolio represents the active part of my total portfolio. I have also changed some positions in the other part of the portfolio. Global ETF’s stand for the biggest share of it. You find more information and monthly updates about it on my blog and my twitter account.

The journey with my own issued wikifolio continues, I will comment quarterly on the development on the blog. I would be happy if some would join this journey – either as investors, ambassadors and/or as discussion partners.