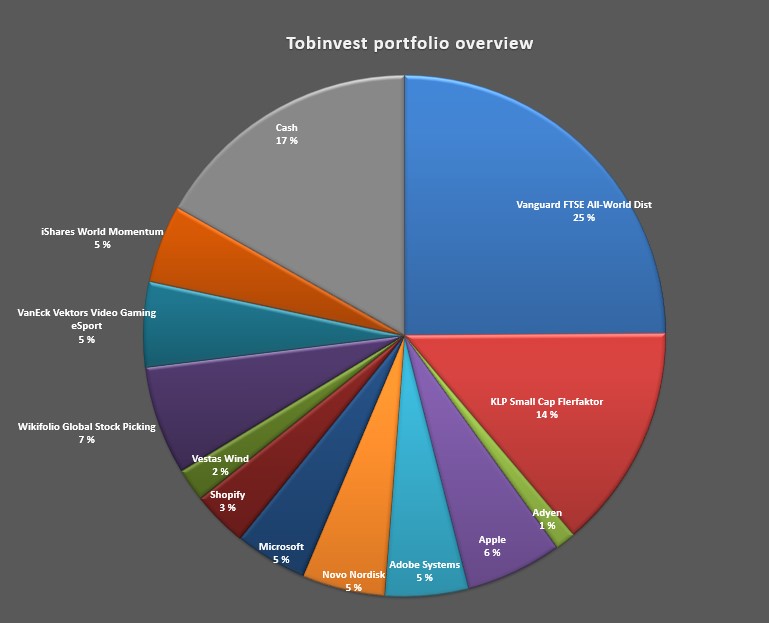

Rebalancing is based on November figures this year. All categories are within their ranges pr November, so there are not many actions required. #buyandhold

Cash 17% (range 0 – 30%)

Core 66% (range 50 – 95%)

Satellite 17% (range 5 – 35%)

There will be additional savings in December, that will increase the cash level to 23%.

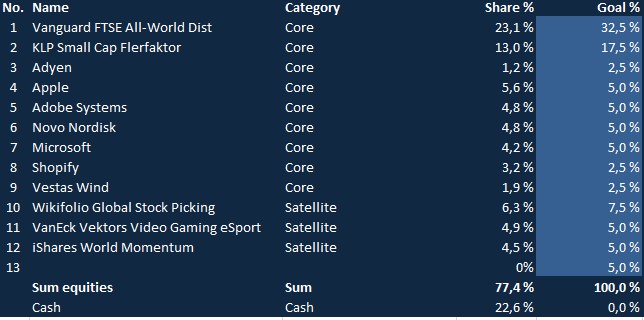

Further investments the next months will be done through monthly purchases of my biggest positions, Vanguard FTSE All-World Dist and KLP Small Cap Flerfaktor. Purchases will be done on the 15th each month.

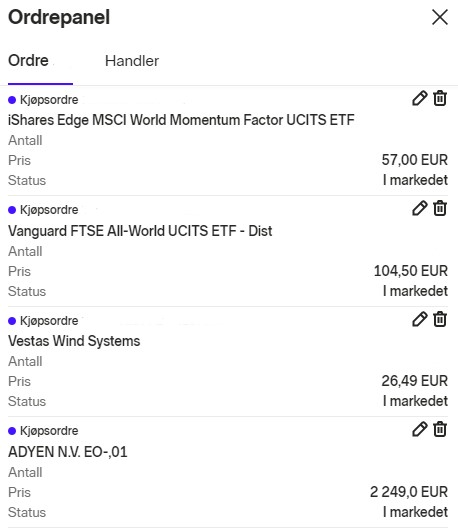

There are also established limit orders that will be valid until the next rebalancing in April. These limit orders are for Vanguard FTSE All-World Dist and some satellite positions (iShares MSCI World Momentum, Adyen, Vestas Wind Systems).

Rebalancing is more simpel this time since I’m satisfied with the structure of the portfolio. The following table shows all positions in my portfolio, their share pr today and goal for weighting in the future. The biggest positions have also most delta to their goals, so I will focus on them the next months.

In case the S&P 500 or the Nasdaq 100 decreases more than 10% from all time high, there will be purchases for a third of the cash reserves. These purchases can be done in existing positions, but I will also consider new positions in that case.