Summary

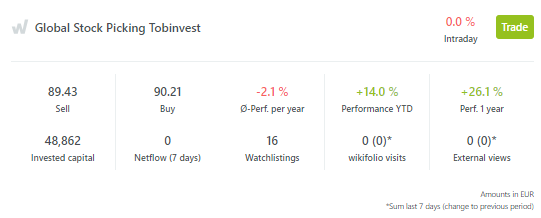

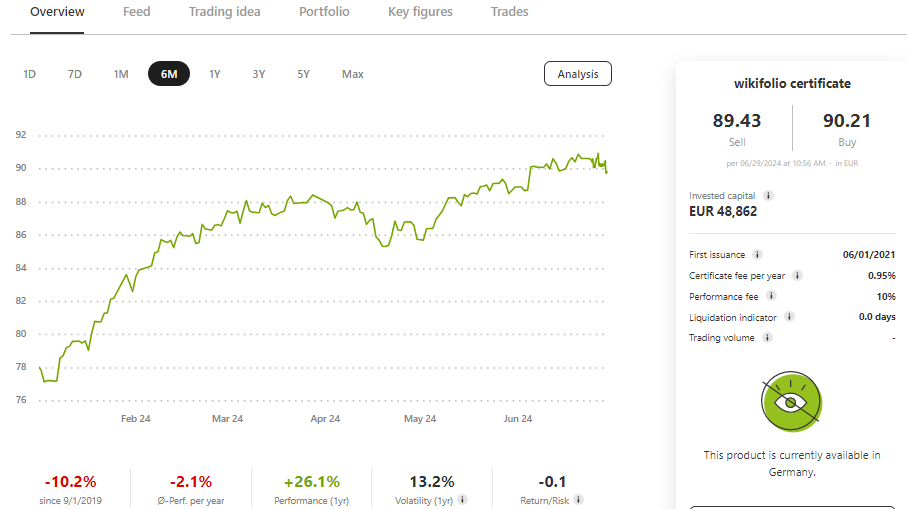

2024 has continued to be a strong year for my Wikifolio, achieving a year-to-date performance of 14%. The first quarter was particularly robust, with an 11.2% gain. However, the second quarter brought more stability, resulting in a strategic move to secure the gains from the initial months.

—

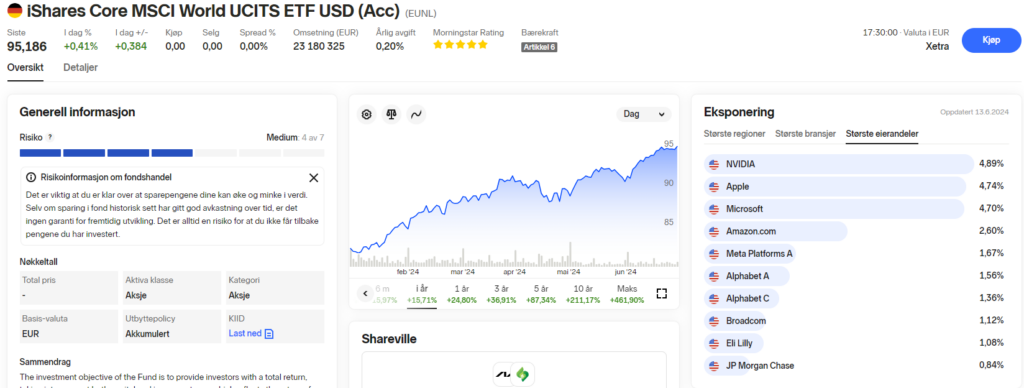

This cautious approach has placed the Wikifolio slightly behind the benchmark, with the MSCI World Core ETF recording a 15.7% gain in the same period.

Looking at the past 12 months, the Wikifolio has demonstrated impressive growth, with a performance increase of 26.1%, compared to the benchmark’s 24.8%.

—

While the recent conservative stance has momentarily slowed the pace relative to the benchmark, the one year performance continues to outshine.

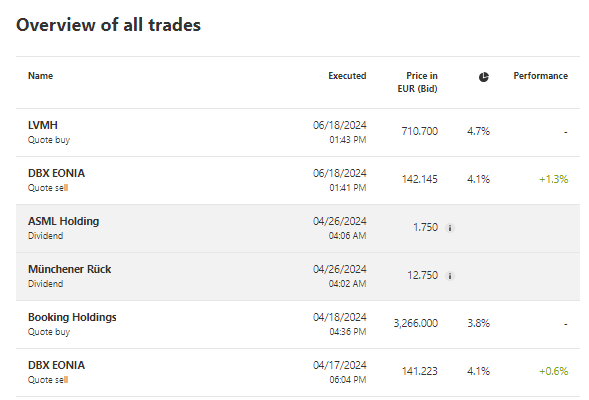

Trades

As part of the strategic plan, portions of the interest bond position were liquidated and reinvested into the stock market. This resulted in the addition of new positions in Booking Holdings and LVMH.

—

Booking Holdings, a provider of travel services, has consistently posted positive results over the past years, frequently surpassing estimates in recent quarters. With a PE ratio just below 30, the company is poised for further revenue and earnings growth.

LVMH, a renowned seller of luxury goods, has experienced significant growth in revenues and earnings in recent years. However, recent months have seen a slowdown due to rising living costs and geopolitical tensions with China and Russia. The current stock price is at 2022 levels, presenting a compelling buying opportunity, particularly as tech stocks, which are my primary focus, have surged to all-time highs.

Looking ahead, the plan is to continue increasing stock exposure on at least a bi-monthly basis. Simultaneously, selling ETFs to balance risk will be carefully considered.

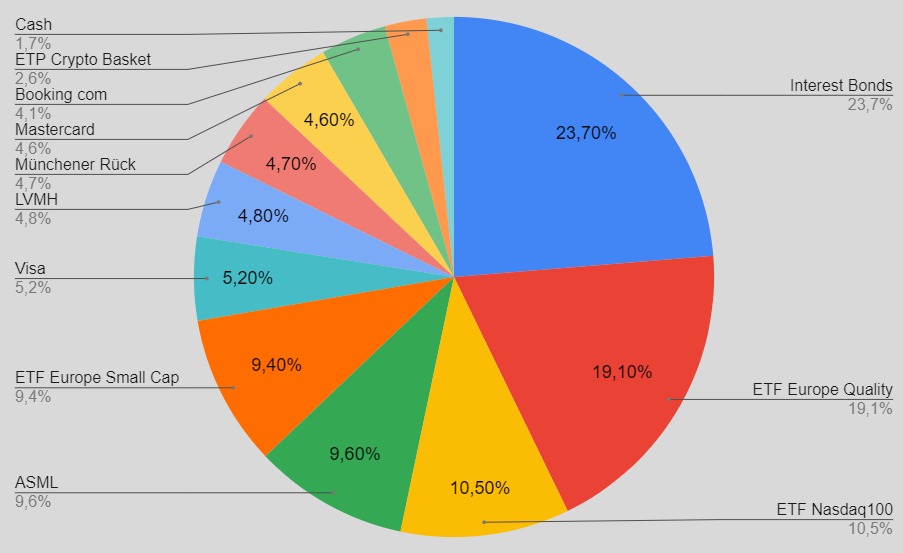

Current portfolio snapshot

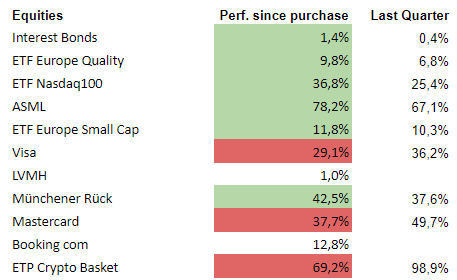

In the last quarter, 86% of the portfolio exhibited positive development, significantly contributing to the overall performance in Q2.

—

Conversely, Visa, Mastercard, and the Cryptocurrency ETP posted negative returns. The decline in Visa and Mastercard is likely attributable to reduced consumer spending, driven by high interest costs and general price inflation. Given that consumer consumption typically rises during the summer months and holiday season, it will be interesting to monitor their performance in the coming months.

Cryptocurrencies, known for their volatility, also experienced downturns. Despite this, maintaining exposure to crypto is a strategic choice for the Wikifolio, necessitating acceptance of its inherent fluctuations.

—

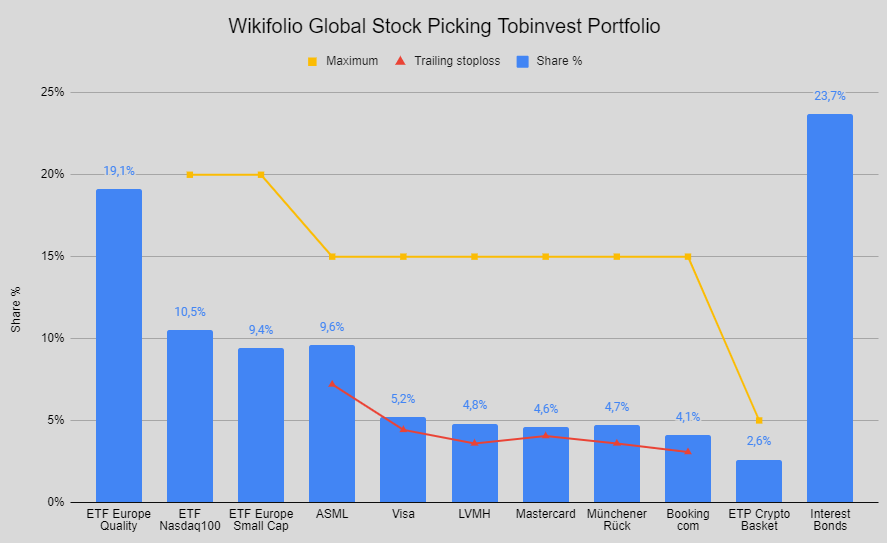

The interest bond position currently holds a 24% share of the portfolio. This position provides a buffer, reminding me of its potential to seize opportunities as they arise.

Stop-loss considerations

Visa and Mastercard have underperformed relative to the rest of the Wikifolio. Their performance will be closely monitored, and selling these positions will be considered if they breach stop-loss levels.

—

The benchmark

The MSCI World maintained strong performance in the second quarter. However, the Wikifolio’s lower exposure to the Magnificent Seven, particularly Nvidia, and the broader stock market, limited its performance relative to the benchmark.

—