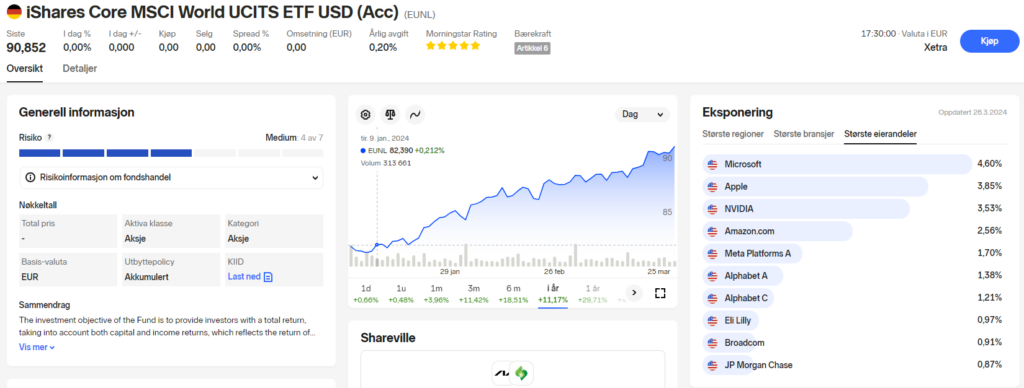

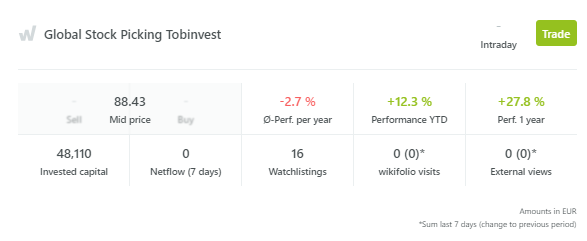

2024 has proven to be a promising year for my Wikifolio, showcasing a year-to-date performance of 12.3%. This encouraging trajectory aligns harmoniously with the broader market trends, as evidenced by the 11.2% gain in the MSCI World Core ETF over the same period. Learn more about Wikifolio

—

Looking back over the past 12 months, the Wikifolio has demonstrated remarkable growth, boasting a substantial 27.8% increase in performance. This robust recovery, following the setbacks of 2022, underscores the resilience of the portfolio.

While the rebound is indeed heartening, it’s clear that sustained momentum is necessary to reclaim previous all-time highs. This ongoing trajectory speaks to the commitment to strategic resilience and steadfast pursuit of long-term objectives.

As we continue to navigate the evolving market landscape, the focus remains on capitalizing on opportunities for growth and maintaining a resilient investment strategy that stands the test of time.

—

During the first quarter, tactical decisions were made to sell positions in CrowdStrike, MercadoLibre, Salesforce, Emerging Markets ETF, Health Care ETF, and Cyber Security ETF. Despite their positive returns, these sales were prompted by a proactive approach to capitalizing on gains and adjusting the portfolio’s composition.

The Wikifolio’s exceptional performance, already surpassing a 10% year-to-date increase by February, exceeded initial expectations. In light of this, it seemed prudent to lock in some profits.

Notably, the sold stocks comprised highly valued growth companies. However, following their sale, several of these assets experienced a downturn. MercadoLibre, Salesforce, and the Cyber Security ETF, in particular, faced challenges in the aftermath of weaker outlooks reported by numerous companies during their year-end reporting.

—

These strategic sales illustrate the importance of vigilance in portfolio management, leveraging positive momentum while also heeding market signals to secure gains and navigate potential headwinds.

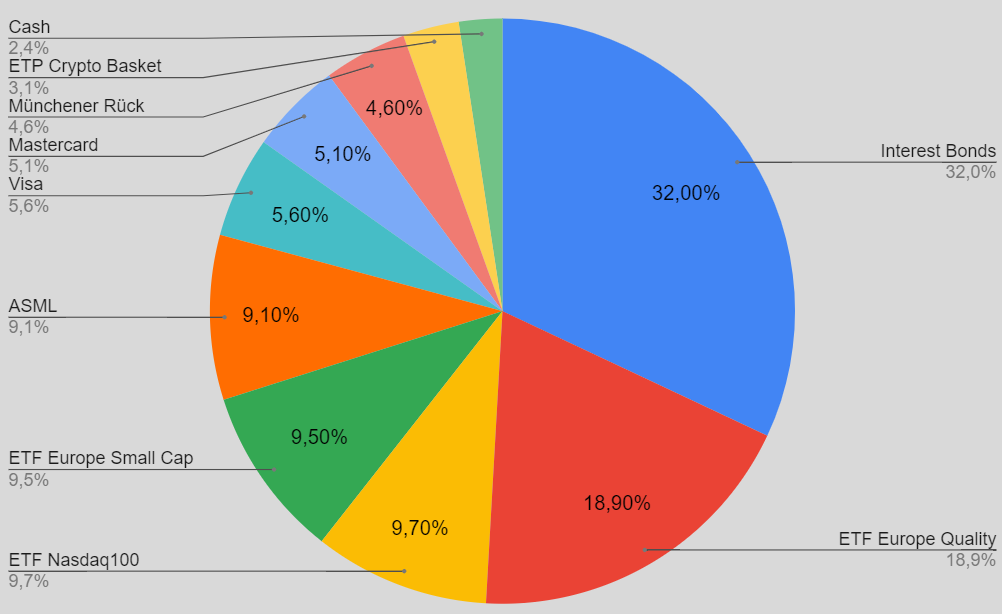

With available cash on hand, a strategic move was made to invest in an interest bond, aiming to mitigate volatility while maintaining liquidity and awaiting favorable opportunities.

While keen on acquiring high-growth equities within the technology sector, current market prices fail to capture my attention. As such, a patient approach is warranted.

The plan ahead involves gradually reducing the interest bond position to capitalize on equities offering greater return potential. Depending on prevailing market conditions, the focus will shift between defensive equities and growth opportunities.

Finding the optimal balance between exercising patience and actively participating in the stock market’s evolution is paramount.

—

Current Portfolio Snapshot:

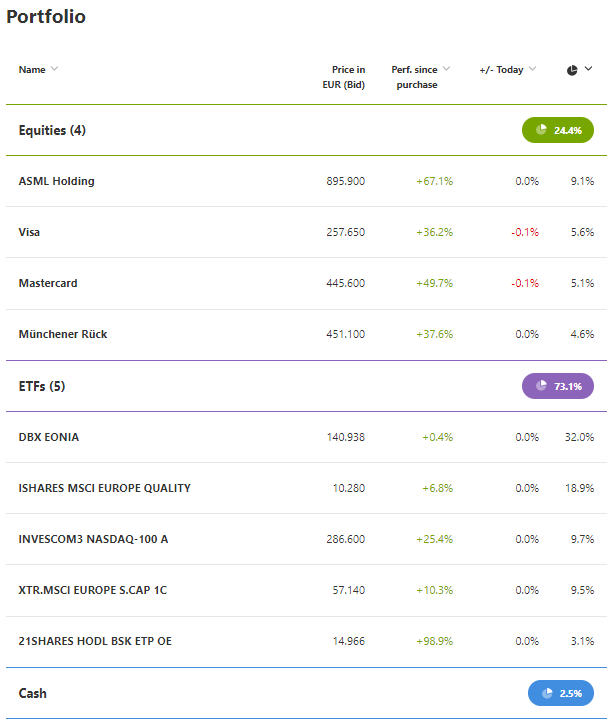

The Europe Quality and Europe Small Cap ETFs exhibit slower growth compared to assets sold in February, yielding modest returns since their acquisition.

The Nasdaq100 ETF is strategically positioned to capture the broader positive momentum in the stock market.

—

ASML is the top stock of the portfolio, capitalizing on the favorable trajectory observed in Nvidia and the semiconductor sector.

Steady growth is maintained with investments in Mastercard, Visa, and Munich Re-Insurance, renowned for their consistent performance.

Within the Wikifolio, a modest allocation to cryptocurrencies is maintained through an ETP tracking major cryptocurrencies’ price movements. Recent weeks have seen a significant uptick in cryptocurrency prices, warranting continued observation as developments unfold.

Currently, none of the equities in the portfolio are nearing their stop-loss thresholds. However, in anticipation of significant market movements, a vigilant approach will be adopted.

—

Should substantial market shifts occur, diligent monitoring will be undertaken, and exposure will be adjusted in accordance with the predefined strategy.

The benchmark