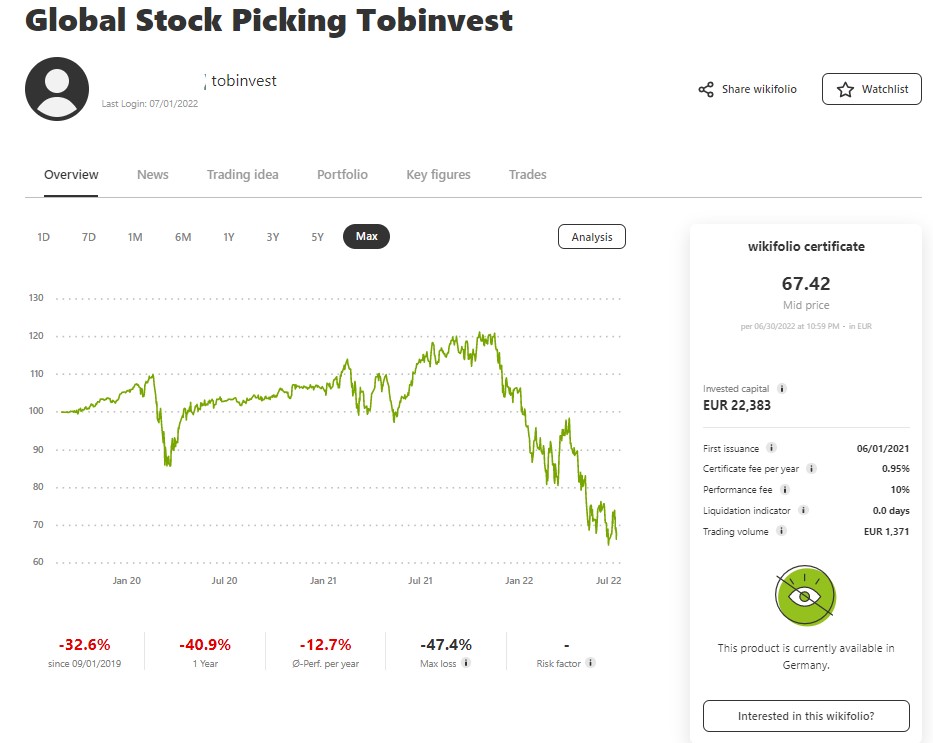

My Wikifolio Global Stock Picking Tobinvest had a poor development also in the second quarter. While the price for a share of the Wikifolio was 94€ at the end of March, it is now 67€. This is a decline of 29%. From the top last year, the Wikifolio is almost 50% down – high growth and high risk.

There is still a lot of uncertainty and volatility in the financial market. The biggest concern at the moment is the fear of a recession in the USA. Inflation is high and interest rates are rising in many parts of the world. Pr now it is uncertain how strong the impact on corporate profits will be. Experts predict that we have to wait for Q4 2022 – / Q1 2023 – results to evaluate the impact on these profits. Patience is required now. #buyandhold

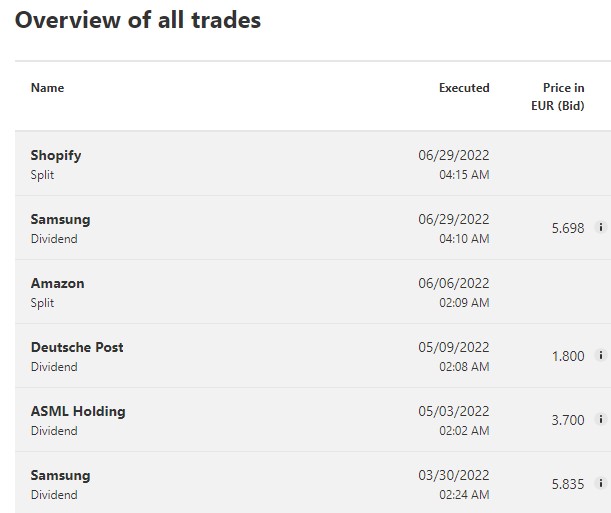

There were no transactions in my Wikifolio in the last three months, just received dividends from ASML, Deutsche Post and Samsung.

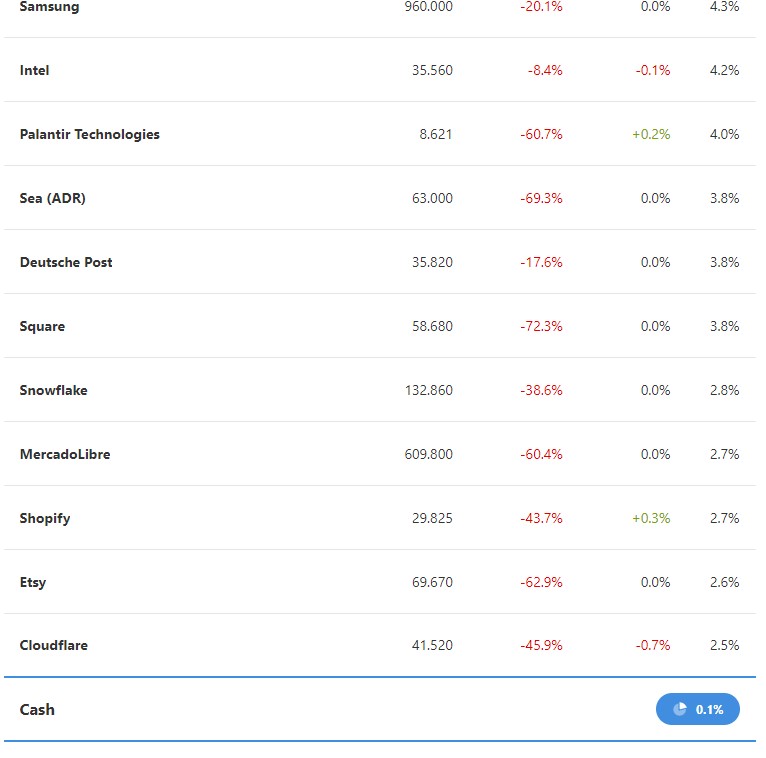

Regarding rebalancing, there are several positions that were held more than 1 year and stand for more than 15% or less than 3% of the Wikifolio at the moment. These levels were established to limit the weighting for each equity and fade out those with poor development.

For the time being, the market is very volatile. Limits were crossed in both directions from several equities during the last weeks. To avoid that short-time market movements having a big impact on rebalancing, it is planned to measure the levels at least at two points. As I’m reporting the status of the Wikifolio quarterly, it is natural to use these reports as a measurement basis. Avoiding this short-time impact will reduce the amount of transactions and therefore transaction costs. The Wikifolio will be more stable and more aligned with my long-term strategy. At the moment I’m uncertain if levels should be measured once a year (as planned earlier) or after each quarterly reporting. I will figure this out later.

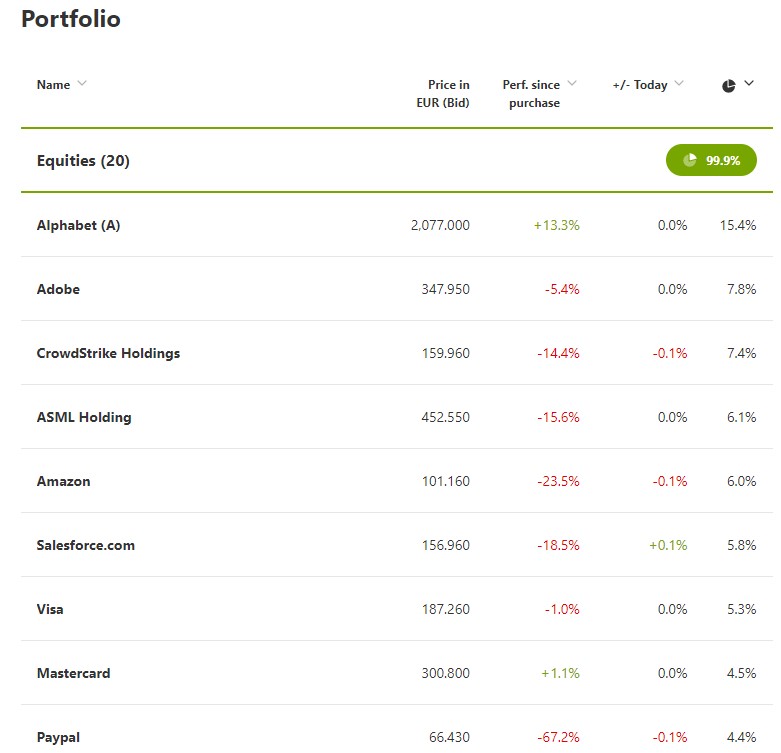

Only 2 equities (Alphabet & Mastercard) have a positive performance since purchase. It is still not the market for Growth / High Tech positions.

10 of 20 equities are companies that have a strong history regarding profitability and growth. I’m convinced that a majority of Alphabet, Adobe, Amazon, ASML, Deutsche Post, Intel, Mastercard, Paypal, Samsung and Visa will contribute significantly when uncertainty due to inflation is gone. The other 10 equities had strong growth in the last years. For these companies, it will be interesting to see if they can maintain growth and become profitable in a longer perspective.

At Q1 2022 no equities were beyond the rebalancing levels, so there will not be any rebalancing transactions after this reporting.

Alphabet (>15%), Etsy and MercadoLibre (both <3%) were in the Wikifolio for longer than one year. These equities and their development will be followed closely in the next quarterly reports.

The Wikifolio represents the active part of my total portfolio. Global ETF’s stand for the biggest share of it. You find more information and monthly updates about it on my blog and my twitter account.

The journey with my own issued wikifolio continues, I will comment quarterly on the development on the blog. I would be happy if some would join this journey – either as investors, ambassadors and/or as discussion partners.